2. Environmental impacts

This section covers the effects, risks, opportunities, governance, strategies, actions, and results of Deloitte's identified material environmental impacts (refer to page 132 for a summary of our material impacts).

In line with the ESRS, we will describe the processes to identify and assess material impacts, risks and opportunities for the environmental sustainability matters not in scope of our reporting due to a lack of materiality.

Table 05: materiality processes and considerations with regard to non-material environmental sustainability matters

ESRS | Topic | Processes and considerations |

E2 | Polution | Offices screened for possible use of polutants in cleaning processes |

E3 | Water and marine resources | Water consumption in offices is measured on a monthly basis |

E4 | Biodiversity and ecosystem | We have identified and assessed actual and potential impacts on biodiversity and ecosystems at own site locations and in the upstream and downstream value chain, using social impact calculations and spend analysis for upstream activities as well as an impact study we performed in 2022 on biodiversity and nature. Our assumption is that there is no causal or material effect of our our downstream activities (audit and business advisory) that affect biodiversity and ecosystems |

E5 | Resource use and circular economy | Waste generation in offices is measured on a monthly basis |

2.1 Climate and CO2

Our day-to-day activities result in CO2 emissions. We burn fuels to heat our buildings and power our car fleet, purchase electricity to charge our cars and we buy airline and railway tickets to travel to clients and attend international network meetings. We also have suppliers who emit CO2 to produce and transport their goods or render their services to us. The CO2 we emit contributes to global warming, which results in widely known environmental impacts such as accelerated sea level rise, more intense heat waves, loss of biodiversity, and much more. This indirectly impacts the wellbeing and safety of people around the globe, but also the continuity of organisations. Extreme weather can significantly impact sites and supply chains. This climate-related physical risk can not only jeopardise the continuity of our clients and thus our engagements, but it also affects suppliers that provide goods and services for the operations of our own organisation.

Due to the nature of our business, the material impact of our CO2 emissions is relatively small. This is confirmed by the Strategic Impact Assessment that we have conducted in 2022/2023. However, the financial implications of climate change and CO2 emissions can be significant. In the short to medium term, not meeting stakeholder expectations could lead to loss of business and difficulty attracting top talent, which we consider to be a climate-related transition risk. Proactively managing our Climate & CO2 impacts can enhance Deloitte's appeal as a business partner and an employer, ensuring ongoing access to the labour market.

In the longer term, Climate & CO2 potentially can hurt our clients’ businesses and with that, our ability to service them. Clients who are asset-heavy or who have invested heavily in asset-heavy industries (such as banks and institutional investors) can especially be affected by the consequences of climate change. They stand to lose both production capacity and value in case their installations are damaged or destroyed by climate-related natural disasters, such as floods or storms. On a larger scale, this can lead to a business continuity risk and with that, a climate-related transition risk to the continuity of our services to such clients.

Many companies are becoming actively aware of climate-related risks and want to move away from a fossil fuel-based economy. This poses a good opportunity for Deloitte to help clients in mitigating climate risks and helping them to become more responsible and adaptive businesses. We help an increasing number of clients with the environmental challenges through our Strategic Growth Opportunity (SGO) Sustainability, a cross-business cooperation that brings together the necessary experience and competences from our audit and advisory businesses.

Climate risk

In December 2023, Deloitte NSE has published a report describing the Climate-related financial disclosures for NSE and its geographies, including the Netherlands. It contains a comprehensive overview of our global climate ambitions, impacts and the risks that apply to our business. Our assessment of financial risks and opportunities in determining materiality is informed by this publication.

NSE climate risk process

Deloitte has a robust process for identifying, assessing, managing and monitoring all risks through the Enterprise Risk Framework (ERF) at both the NSE and local National Practice levels.

The ERF sets out the assessment of principal and emerging risks facing the firm, specifically those that could impact Deloitte’s ability to achieve its strategic priorities, meet its public interest obligations and protect its reputation and people. Climate change and sustainability matters, alongside other business risks and opportunities, are considered and embedded within the ERF.

The ERF prioritises risks based on residual exposure. This is achieved through the ‘risk dashboard,’ which assesses the residual exposure of risks and opportunities, including those related to climate. Residual risk exposure describes the likelihood of a risk crystallising, and its impact on Deloitte given the current ability to mitigate or manage it, and is categorised as very high, high or medium. Risks and opportunities are considered against four impact dimensions: strategy and market differentiation, brand and reputation, operational and financial resilience, and people and purpose.

Material climate-related risks and opportunities include consideration of both physical and transition risks. These include consideration of existing and emerging regulatory requirements, such as jurisdictional policies that are being introduced to deliver against jurisdictional commitments, as well as changes to client behaviour and threats to reputation.

The risks and opportunities are assessed in line with Deloitte’s risk methodology and governance processes and are informed by qualitative scenario analysis. As such, climate change is integrated into decision-making through consideration alongside other business risks within the ERF.

The Enterprise Risk Management (ERM) Team facilitates the ERF and, along with other enterprise risks, climate-related risks are assigned an Executive Risk Owner who oversees work carried out by management teams within the organisation to manage those risks. Executive Risk Owners are responsible for continually monitoring the effectiveness of the risk management and mitigation plan. Residual exposure is discussed and assessed during regular meetings between the ERM team and each Executive Risk Owner. These meetings also focus on the internal and external drivers of the risks and the work required to manage them, alongside the effectiveness of existing mitigations and the status of any actions deemed necessary to further enhance these mitigations. Outcomes are reviewed by both the ERM team and Executive Risk Owners, then updates are included within the ERF.

The ERM team uses a risk dashboard to enable ongoing assessment of climate-related risks and other business risks. It is used to inform, refresh and validate the status of each risk with the respective Executive Risk Owners and the NSE CRO twice a year on a mandatory basis. At these reviews, the Executive Risk Owners and the NSE CRO assess whether current risk management activities are sufficient. If additional action may be or is required for climate-related risks, these are prioritised and given ‘special focus’ (requires more detailed management monitoring) or ‘action required’ (immediate additional mitigating actions are required) status, and more detailed management and monitoring will be carried out as a result. Management teams are accountable for implementing risk management and mitigation plans. The NSE World Climate team (which manages the firm’s own sustainability transformation, including its climate response) holds regular discussions with the Executive Risk Owners and the NSE CRO to gain insight and consult on progress relating to climate-related risks.

Executive Risk Owners’ residual risk assessment for each climate-related risk and opportunity, is presented to the NSE Executive for approval and NSE ARC for review and oversight, with plans to manage and monitor the risks communicated to the NSE ARC twice a year.

As outlined above, the process for identifying, assessing and managing climate-related risks and opportunities is fully integrated into Deloitte NSE’s overall risk management process. The end-to-end climate-related risk management process is owned by the Climate SteerCo to ensure progress against identified climate-related risks and opportunities is monitored, outcomes are evaluated and a holistic view of climate-related impacts on Deloitte is provided to the NSE Executive.

Time Horizons

For the purpose of defining climate-related risks and opportunities, Deloitte maintains time-horizons that deviate from the definitions provided in section 1.1 of this Annex:

-

Short-term: the next fours years, which alligns with Deloitte's internal planning and forecasting frameworks;

-

Medium-term: 4-7 years, in line with our WorldClimate near-term 2030 targets;

-

Long-term: greater than 7 years (up to 2050), in line with UK and EU jurisdictional net zero targets.

Climate Scenarios

Deloitte has identified the Network for Greening the Financial System (NGFS) Climate Scenarios as the publicly available resource most relevant to Deloitte NSE when it comes to understanding how climate change, climate policy and technology trends could evolve in different futures. Deloitte is not a financial services provider or institution; it is a professional services organisation with diverse geographic and sectoral exposure similar to that experienced in the financial services sector. It was therefore decided that the NGFS scenarios, rather than, for example, the World Business Council for Sustainable Development (WBCSD) scenarios, which are designed for energy companies, would be most suitable to better understand Deloitte NSE’s future possible climate risk and resilience.

Deloitte selected three scenarios – Current Policies (3°C), Divergent Net Zero and Orderly Net Zero by 2050 – to assess the impacts of climate-related risks and opportunities across the applicable short, medium, and long-term time horizons. Choosing two net zero scenarios with similar policy ambitions (below 1.5°C) but different policy reactions enable a range of risks and opportunities to be captured in a transition scenario, factoring in the market and regulatory drivers to which Deloitte NSE is most exposed to. This is particularly true given the comparable climate policies and net zero ambitions of the UK and EU, and the relative financial importance of these markets to NSE’s overall revenue. The Current Policies scenario captures the extreme warming future where physical climate impacts could put business operations and continuity at risk.

Analysis was performed using the firm’s internal scenario modelling, which assessed each climate scenario’s potential positive and negative implications. The selected scenarios enable Deloitte to assess robustly the impacts of climate change over the short, medium, and long-term under three possible pathways, with global warming ranging from 1.5°C to 3°C.

Process for defining climate-related risks and opportunities

The climate-related risks and opportunities assessment used the same likelihood and impact risk criteria as the firm’s ERF, which is described in the Risk management section above.

Identified climate-related risks and opportunities were assessed by members of the Climate SteerCo (as well as other key stakeholders across NSE’s operations) by scoring the likelihood and impact for each risk and opportunity. Together with qualitative analysis based on market data, an average combined score was then calculated for each risk and opportunity to understand the significance to Deloitte. Following consideration and approval by the Climate SteerCo, the climate-related risks and opportunities that were determined to have a potential impact on the business have been disclosed below.

Two types of climate-related risks and opportunities have been determined as having a potential impact: physical (acute and chronic) and transition (market, reputation, policy and legal). Further analysis has been performed for these, including impact assessments and scenario modelling (against the three scenarios identified above), analysis of the firm's strategy and business model resilience and corresponding strategic responses. The results have been included in the table below.

Climate-related risks and opportunities are considered in Deloitte’s strategic, operational, and financial planning process and this ensures decisions not only align to the firm’s purpose but contribute to the economy-wide low-carbon transition. Deloitte’s strategic response to climate-related risks and opportunities is founded on its World Climate strategy and its transition to a sustainable business – please refer to the Policy section in this report.

Summary of Material Climate-Related Risks and Opportunities

The table below shows the list of climate-related risks and opportunities identified as having a potentially material impact on Deloitte NSE.

As a professional services organisation, the firm considers the impact of climate-related risks and opportunities to be consistent across its primary service offerings (Consulting, Financial Advisory, Risk Advisory, Audit & Assurance, Tax and Legal), so has not performed sector-specific analysis. Similarly, due to the global nature of Deloitte’s operations, geographic impact has not been considered for the below transition risks and opportunities as the firm expects these to be largely consistent across all NSE National Practices. On the opposite, geographic impact for physical risks is considered in this report for Deloitte NL and complement the analysis, performed on NSE level.

Due to the limited availability of public data and the extensive number of assumptions involved, Deloitte has not quantified the financial impact of these risks and opportunities at this time. Instead, Deloitte has performed a qualitative impact assessment through narrative alone. Quantification of the financial impact (e.g., revenues and costs) on all climate-related risks and opportunities will be further developed in future reporting periods.

Table 06: Material climate-related risks and opportunities

Risk or Opportunity | Description and Potential Impact to Deloitte NSE | Potential Impact under Climate Scenarios and Time Horizons | Strategic Response and Resilience |

|---|---|---|---|

Physical: Acute and Chronic | Climate-related physical risks could impact Deloitte’s infrastructure and employees, and could result in reduced revenue caused by business disruption and productivity loss. These impacts could be driven by acute (e.g., increased severity of storms, floods and wildfires) or chronic (e.g., rising mean temperatures) physical risks | In all scenarios, physical risks to Deloitte will increase from the short to medium-term. Physical risks are expected to be identical in the short-term due to ‘committed warming’ (emissions already released). In the medium term, under the Net Zero scenarios, physical risk impact should plateau. Under a 3°C scenario, the frequency and severity of extreme weather events will continue to increase over the medium and long-term. The risk to NSE infrastructure and employees and corresponding revenues over the long-term aligns accordingly. | Deloitte is exploring a range of mitigants to respond to climate-related physical risks, for example through the firm’s agile and flexible working approach. This helps mitigate productivity loss resulting from acute physical risk events given many Deloitte employees can carry out a significant proportion of their work remotely at a time that is convenient to them. |

Transition: Market | The firm recognises that it will be impacted in some way by the policy, market and technological changes brought by a transition towards a low-carbon economy. The precise nature and scale of the impact for certain sectors and companies is currently unclear. However, due to the size of Deloitte’s client base, it is inevitable that some clients will be negatively impacted, which could have a knock-on effect on Deloitte’s ability to provide services to those clients and, therefore, generate revenues. | Exposure to climate change is of a different nature under each scenario and will inevitably impact the services Deloitte provides. Under a 3°C scenario, companies will face ever-increasing impacts from physical risks in the medium to long term but less so from transition risks. In the Divergent Net Zero scenario, companies are less likely to be impacted in the short term as neither physical nor transition risks are prevalent but may experience growing transition risks in the medium term and acceleration of these in the long term. Meanwhile, under the Orderly Net Zero scenario, companies are expected to face transition risks concentrated in the short and medium term but less so in the longer term as they adapt. | Deloitte’s ability to work across multiple sectors and geographies, and with numerous organisations from listed to entrepreneurs, results in a diversified business and acts as a form of mitigation against the risk. As a result of this diversified portfolio, the firm is well equipped to identify, adapt and pivot its client portfolio in line with a low-carbon economy. |

Transition: Market | Deloitte benefits from being a global business with a breadth of skills, resources and experience developed through its long-standing relationships with companies across multiple industries. | All three scenarios are anticipated to provide opportunities to increase revenues from climate and sustainability services, but these may vary in nature and timing of service demanded. | Deloitte is already responding to this demand. In 2022, the firm announced a global investment (including NSE) of US$1 billion in client-related services, data-driven research and other capabilities focused on sustainability and climate change. |

Transition: Reputation | People are at the heart of Deloitte’s operations and service offerings. In the Deloitte Global 2023 Gen Z and Millennial Survey, professionals reported strong views on the importance of employers acting on climate change, with over half of Gen Zs (55%) and millennials (54%) saying they research a brand’s environmental impact and policies before accepting a job. Approximately half of Deloitte’s employees are aged below 30 (Gen Z or millennial), indicating that its response to climate change may impact perceptions of the firm’s current and future workforce, driving attrition and retention trends. | Under all three scenarios, the awareness of climate issues and the need to embrace action will influence employment decisions and depending on the firm’s performance and credentials, could result in a risk or opportunity. Within this, it is reasonable to expect that a more significant proportion of the population will make choices driven by an awareness of climate change and a desire to contribute to the transition through, for example, employment choices in the short, medium and long term. | Deloitte is committed to achieving the near-term (2030) carbon reduction goals defined in its WorldClimate strategy. These cover the firm’s operations and its value chain, with commitments to decarbonise, also helping clients to reduce their own scope 3 footprint and support the economy-wide low-carbon transition. It showcases the work it does with clients and partners to accelerate the low-carbon transition in its annual reports. |

Transition: Reputation | As a leading professional services organisation, Deloitte NSE is highly dependent on its brand and public perception. These contribute to the firm’s ability to continue to act in the public interest, as well as build new, and strengthen existing, client and stakeholder relationships. If Deloitte is perceived to have inadequately addressed climate change within its own operations and value chain, there is a risk that the public will lose confidence in the services Deloitte provides, and clients may choose to limit, or not engage in, business with the firm. Any damage to reputation and client relationships is expected to affect the firm’s revenues and business growth. | Under the Net Zero scenarios this risk increases from the short-term onwards. This is as a result of increased policy requirements and increased client action or expectation. Deloitte will need to match or exceed this pace of change to avoid losing contracts and revenues. Under the 3°C scenario, the risk will only increase in the longer term as the expectations to transition in response to climate change will be lower. | Deloitte is committed to achieving the near-term (2030) carbon reduction goals defined in its WorldClimate strategy. These cover the firm’s operations and its value chain, with commitments to decarbonise, also helping clients to reduce their own scope 3 footprint and support the economy-wide low-carbon transition. It showcases the work it does with clients and partners to accelerate the low-carbon transition in its annual reports. |

Transition: Reputation | Deloitte’s brand and reputation is driven in part by the clients it serves. As such, providing services to (or being associated with) companies or sectors that are perceived as having unfavourable climate credentials or that are not willing to respond to climate, have not articulated a credible transition plan or are not transparent about their actions to address climate change could damage Deloitte’s reputation. | Climate-related litigation is expected to rise under all three scenarios, but the phasing of the increase will vary. This risk is expected to materialise fastest in the short term under the Orderly Net Zero scenario as stricter climate and greenwashing regulations would be introduced sooner. Climate-related litigation claims are still expected to increase for the Divergent Net Zero and 3°C scenarios, but over the medium and long terms in response to more delayed regulatory transition scenarios. | To mitigate potential impact on its reputation, the firm is diligent in deciding which clients it works with and the work it does for them. For example, its client and engagement acceptance procedures enable Deloitte to assess, and be resilient to, potential reputational damage, with escalation to National Practice or NSE Public Interest and Consistency Groups in particularly challenging cases. Such groups consist of firm partners who meet regularly to review and challenge client opportunities with a public interest element. |

Transition: Policy & Legal | The desire of organisations to consider climate-related impacts and respond to related legislation has increased, and is likely to continue increasing, the demand for Deloitte’s services. This could result in Deloitte facing a corresponding increase in the frequency and severity of climate-related litigation, and/or accusations of greenwashing if the firm fails to deliver on quality. Such an increase in the frequency and severity of climate-related litigation claims could impact future costs incurred by Deloitte and lead to reputational damage. | Climate-related litigation is expected to rise under all three scenarios, but the phasing of the increase will vary. This risk is expected to materialise fastest in the short term under the Orderly Net Zero scenario as stricter climate and greenwashing regulations would be introduced sooner. Climate-related litigation claims are still expected to increase for the Divergent Net Zero and 3°C scenarios, but over the medium and long terms in response to more delayed regulatory transition scenarios. | Deloitte ensures a robust, proactive and effective approach to quality management throughout each of its services (e.g., Deloitte’s Audit & Assurance practice complies with the International Standard on Quality Management (“ISQM”) 1). The firm also provides its practitioners with mandatory training to understand the policies, practices, and standards they must follow while performing work both internally and for clients. Similarly, the firm conducts internal reviews of climate-related engagements to ensure high quality and reduce the risk of reputational damage to Deloitte due to climate-related matters. |

Considerations and conclusions from Deloitte Netherlands

Deloitte NL operates as a company with a relatively low investment in physical assets. According to the notes in the financial statements, sections 4.3 and 4.4, there is a clear differentiation between assets owned by Deloitte and those owned by others, which Deloitte has the right to utilise. The value of assets owned by Deloitte is € 57 million, primarily comprising office furnishings and (portable) IT equipment. The only Deloitte-owned asset that might be susceptible to the physical impacts of climate change is our data centre located in Amsterdam. However, as there are plans to decommission this facility within the 2024/2025 timeframe, we do not consider physical climate risks to be significant for this asset. Similarly, mobile data devices such as laptops and mobile phones are not considered to be at material risk from climate change. Depreciation of office-related assets is always in line with the duration of the specific office rental contracts, meaning that physical risks are mitigated to a level that we do not deem them to be material.

Assets owned by others mainly consist of rented office buildings and leased vehicles. Transition risks for vehicles are mitigated by our fleet's progressive transition to electric vehicles. An uncertainty in this area is the installed capacity of the national grid in the Netherlands: in certain areas of the country there is already an overload of the electricity infrastructure. We do not perceive to have any material physical climate risks to our leased vehicles, partly because the maximum lease duration is set at five years. Regarding office spaces, we engage in temporary lease agreements, which afford a level of adaptability in our portfolio of offices should there be shifts in business conditions prompted by climate change. As a result of our approach, we do not regard transition or physical climate risks to assets owned by third parties as material.

As we don’t have many own assets and have flexibility in our leased ones, none of our assets are at material transition risk. An exception may be our fossil fuel powered lease cars which are already planned to be completely phased out in 2025/2026. None of our assets are at material physical risk as a result of the climate change adaptation actions that we defined in the context of our WorldClimate programme (see pages 146-147).

In terms of revenue, we do not believe our revenue to be at risk due to physical climate risks in the short or medium term as our business is volatile and climate opportunities exceed climate risks. For the longer term, together with our NSE partners, we will further investigate what our clients’ exposure is to physical climate risks and we will assess what the potential impact is on their business continuity.

We have set up a robust governance structure to manage our GHG emissions along with other sustainability matters. We have a dedicated Internal Sustainability Team in place that reports to the Executive Board, and have created a Sustainable Operations Team that consists of various topic owners (housing, fleet, travel, IT, procurement, talent and communications) to design and implement policies. Our businesses are connected through a Climate Champions Network, a group of passionate sustainability adepts from across our businesses. We have also assigned senior leaders from each business to form a group of Sustainability Operational Excellence Leads. This group is responsible for embedding sustainable practices in the daily operations of their businesses.

On an international level, we are part of the Deloitte NSE WorldClimate structure and thus take part in collaborative efforts to move our strategy to reduce our CO2 emissions forward and report in to the NSE Chief Sustainability Officer on progress and performance. We are also part of the Deloitte Global network that provides up with extensive guidelines on our material topics and through which we account for our progress and metrics.

Overall

Deloitte feels responsible to do what is necessary to halt climate change. To reduce the negative impact from our business on global warming, DTTL has adopted the WorldClimate strategy. WorldClimate drives responsible climate choices within our organisation and beyond. We are committed to transforming our business to reach net zero, and using our skills and influence to inspire change by others.

This ambition is to be achieved by reducing where we can, and compensating in a meaningful way where we must, and is supported by a number of near-term science-based targets to be achieved by 2030 that have been verified by Science Based Targets initiative (SBTi) as being aligned with the 1.5⁰ C path set out in the Paris Agreement:

-

Reducing our business travel emissions (flights and international rail) by 50% per FTE from 2019 levels (realisation 2023/2024: 61.7% reduction/FTE);

-

Sourcing 100% renewable energy for our buildings (realisation 2023/2024: 88.7% for buildings where we are responsible for energy purchasing, 86.7% for buildings where we are not);

-

Converting 100% of our fleet to electric vehicles (realisation 2023/2024: 60.3% fully electric);

-

Engaging with our major suppliers with the goal of having two-thirds of them adopt science-based targets for carbon reduction within five years;

-

Investing in meaningful market solutions for emissions we cannot eliminate.

Other elements of WorldClimate are:

-

Embed sustainability: We align our climate policies, practices, and actions across our organisation with our sustainability ambitions.

-

Empower individuals: We will empower our people to be better informed about professional and personal climate change impacts.

-

Engage ecosystems: We will collaborate with clients, alliance partners, NGOs, industry groups, suppliers, and others to accelerate the sustainability transition.

We have also committed to set long-term emissions reduction targets using the SBTi’s Net Zero Standard.

As Deloitte NL, we have fully embraced the WorldClimate programme and have committed to reach our operational reduction targets (housing, mobility and travel) by 2025, five years ahead of the DTTL target. For other indirect emissions we follow the timeline defined by DTTL.

Mobility

Our mobility policy offers our employees the choice between Mobility+, a leased car (including the option to travel to work by public transport), a cash option or unlimited public transport through the Shuttel card. Through our Mobility Policy, we are phasing out the use of fossil fuel powered vehicles and transitioning to fully electric or hydrogen powered cars in our lease fleet. Until April 2024, we did so by:

-

Lowering the own contribution for private use of the electric car by 50%;

-

Determining that all contracts for fossil fuel cars, including hybrid ones, shall not extend beyond 2025 making it increasingly expensive to lease non-electric vehicles.

Since May 1, 2024, it is no longer possible to order a new leased car that is not fully electric.

The scope of our policy is our own organisation and therefore it applies to all partners and employees. For some employees or apprentices, another scheme (the Mobility Scheme) applies. Within this mobility arrangement, employees are encouraged to use public transport or shared mobility options. They can also apply for an allowance per travelled kilometre with their own means of transportation. With our mobility policies, we aim to mitigate climate change by making our people choose more sustainable ways of transport.

We implemented a new mobility card and application (Shuttel). This card and app help our people to easily manage their mobility needs in a sustainable way. The Shuttel app provides the option to view all available transport options for a specific route, provides access to all public transport, including shared mobility options, and facilitates the comparison of CO2 emissions of all the alternatives proovided by the app. In line with government's climate agreement goals for 2030, this allows all employees to keep track of their business travel movements and expenses, and help us take measurable and decisive actions towards reducing our carbon emissions in line with our WorldClimate ambition and the Paris Agreement.

Business travel

Our business travel policy outlines the conditions that we have set for international travel. We encourage our people to travel for business only when necessary, for example by switching to virtual and or hybrid meetings or staff locally where we can. We expect that at least half of non-client meetings that were face-to-face in 2018/2019, to be conducted virtually. When a trip is necessary, the aim is to travel in a way that prevents unnecessary CO2 emissions and costs. In line with our reduction ambitions, we prefer rail over flying for short international travel where practical. We have defined additional guidance concerning travel classes on international flights, encouraging employees and Partners who travel on intercontinental flights to choose Economy or Economy Premium class. For air travel under six hours only Economy class is allowed. With our business travel policy, we aim to mitigate climate change by reducing the amount of emissions from flights we take and the hotels we stay in.

Housing

Deloitte strives to utilise office spaces in energy-efficient buildings, such as our Amsterdam office, 'The Edge', which holds a BREEAM Outstanding certification, and our Rotterdam office in 'Maastoren'. We prioritise renting buildings that already support sustainable practices and collaborate with landlords to source renewable energy wherever possible. Where we buy energy ourselves, Deloitte is actively engaged with Groendus, an energy marketplace that matches supply and demand for sustainable energy sources. In instances where direct green energy procurement is not yet the standard practice, we leverage our position as tenant to encourage landlords to switch to sustainable energy sources. Meanwhile, to offset our emissions resulting from our energy consumption, we purchase Renewable Energy Certificates. This practice extends to the electricity used for powering our electric vehicle fleet.

Furthermore, we are committed to continually enhancing our building operations and energy efficiency by implementing the 'Better Buildings Toolkit' developed by DTTL. Our overarching goal with these initiatives, encapsulated in our Housing Policy, is to substantially reduce emissions from the energy used in heating and cooling our offices across the Netherlands. This policy is a crucial component of our broader strategy to combat climate change and applies specifically to our operations within the country.

Monitoring

In order to track our CO2 emissions to determine the effectiveness of our actions and policies, we operate a CO2 Emissions Dashboard for fleet and air travel. This dashboard is updated every quarter with the latest data we receive from our suppliers. It is accessible to all our employees not only in order to provide transparency but also to stimulate our employees to change their own behaviour and choices. We have also developed a Carbon Forecasting Tool to forecast the effects of our policies on our CO2 emissions in the medium to long term. This tool is integrated with other planning tools of our organisation.

Through our monitoring, we aim to mitigate climate change by ensuring we have the right insights to purposefully steer our behaviour and, consequently, further reduce our emissions.

(Beyond) Value Chain Mitigation

Deloitte NSE has compensated the CO2 emissions from 2022/2023 for all NSE geographies by investing in a number of certified carbon avoidance and renewable energy projects from third parties. In addition, Renewable Energy Certificates were acquired to ‘green’ all our non-renewable electricity consumption, including those to charge our electric fleet. Once total CO2 emissions for Deloitte NSE in 2023/2024 have been verified, NSE will buy credits to compensate the majority of these. In addition, Deloitte NSE has started to participate in Beyond Value Chain Mitigation (BVCM) projects from around the NSE geographies, including in our own nature-based carbon storage project in the Dutch Caribbean, where we have piloted carbon sequestration by replanting mangroves (see paragraph 5.1 of this annex for more detail). BVCM is defined by SBTi as “mitigation action or investments that fall outside a company’s value chain, including activities that avoid or reduce GHG emissions, or remove and store GHGs from the atmosphere”. The compensation and BVCM investments by NSE have no impact on the reported emissions from Deloitte.

Empower individuals

To promote the sustainable delivery of our services, we have the Sustainable Delivery Framework (SDF) in place. The SDF is a set of tools that provide guidance and empowers our teams to adopt sustainable ways of working and reduce our travel emissions. This framework contains background information on climate change to help our people to start and conduct meaningful conversations with our clients, as well as a number of concrete tools to deliver their work in a sustainable way. It enables our people to educate themselves on climate change and guides them to drive the sustainability agenda at work and in their personal lives. Examples of tools in the SDF are the carbon calculator, which predicts engagement related carbon emissions so these can be discussed with the client, and the sustainable events guide, a tool that contains practical advice on how to organise sustainable client events.

As part of our ‘Empower Individuals’ strategy, we run GiKi Zero, a tool that enables our people to calculate, track and reduce their own personal carbon footprint, offering advice and examples of actions they can take to live more sustainably. Both the Sustainable Delivery Framework and GiKi Zero are facilitated by our Climate Champions Network.

Certification

Since April 2023, we have held a Level 3 certification under the CO2 Performance Ladder certification scheme. We have published the certificate and the supporting documentation on our public website .

We also maintain an EcoVadis company profile. Through this scorecard, we provide transparency about our management system to addresses sustainability criteria, as outlined in the EcoVadis methodology. Our scorecard is available to trading partners on request.

Governance

In our previous annual report, we stated that we aimed to further integrate internal sustainability in the activities of the SGO Sustainability, capturing the learnings from our own journey to improve our client sustainability services. We have done so by bringing our Deloitte NL Internal Sustainability Team and the SGO Sustainability closer together by appointing a shared reporting line, creating shared overview.

We are working on setting and validating our long-term Science Based Target to reach Net Zero at a Deloitte NSE level and will be looking to start implementing our targets set within once validated.

Mobility

We updated our Mobility policy as of June 1, 2023 (see above under ‘Policies’). In addition, we have continued the transformation of our fleet by phasing out fossil fuel powered vehicles, replacing them with fully electric or hydrogen powered cars. For standard fossil fuel leased cars however, the end date of the contract of use was set at December 31, 2025 at the latest, making it increasingly expensive for the employee to lease such a car. This approach has resulted in very few people still opting for new fossil fuel powered cars in 2023/2024.

Business Travel

We have continued to operate our Travel Policy with the aim of reducing our business travel emissions by 50% per FTE from 2019 levels. During 2023/2024, as a result of our continued focus on reducing international travel, related CO2 emissions per FTE further decreased.

Furthermore, we have been working on enhancing our video conferencing facilities in our offices, as well as for people working from home, resulting in better virtual working experiences and allowing us to still engage in meaningful ways, but reducing the need to travel locally or internationally.

Housing

We extended a long-term lease for our Amsterdam The Edge office. The Edge is renowned worldwide for its ground-breaking sustainable design and smart technologies, which not only minimise our ecological footprint, but are also aimed to create a dynamic and healthy workspace for everyone at Deloitte. In the course of the extension, landlord Deka Immobilien and Deloitte have agreed on additional improvements to take sustainable building management to the next level and thus meet the highest future requirements, the BREEAM In Use Excellent standard, and Paris Proof. This renewal is a powerful affirmation of our collective dedication to sustainability and innovation.

Embed sustainability

Sustainability initiatives in IT

We have implemented several sustainability initiatives in IT that help us reducing our carbon footprint. We are implementing sustainable IT practices within procurement and vendor management practices. In addition, we use rechargeable accessories and USB-C adapters for iPhones made of recycled plastic. When employees leave, or hardware is retired, devices are centrally collected for reuse or recycling. We have been working towards full circularity for all hardware assets. The iPhones we use are renewed, our laptops and MFD fleet (printer and scanner devices) are EPEAT Gold certified. For data storage, we have reduced our carbon footprint by migrating solutions from our own on-premise data centres, to highly energy efficient data centres run by cloud service providers.

Sustainable renovation of our office facilities

Within The Edge we are expanding our workspace. This expansion will provide more than 400 desks and over 20 meeting rooms. The current floors will be optimised as former archiving spaces and printer rooms will be freed up, providing space for additional single focus, project, meditation and relaxation rooms. In addition, approximately 15 new meeting rooms will be realised on these floors. As part of this expansion, we calculated the carbon footprint of the office design and investigated how we can minimise our footprint by using more sustainable materials and products. We also applied this approach for the fit-out of our The Hague office in March 2023 and are embedding the learnings from that experience into our approach for The Edge.

Replacing computer monitors

In 2023, 1,369 monitors were replaced with new ones. The uninstalled monitors were sold to a third party buyer that cleaned and reused the old monitors. The reuse of these IT products implied savings on product carbon footprint of new products that, as calculated by the buyer, amount to 702 tonnes of CO2.

Certification

We have renewed our certification under the CO2 Performance Ladder certification scheme. The certificate and the supporting documentation is disclosed on our public website . Furthermore, we have renewed our EcoVadis assessment.

Empower individuals

We are empowering our people to be better informed about professional and personal climate change impacts through a number of activities that we highlight below.

Education and activation

We continued our engagement with the Climate Champions network to help create awareness of WorldClimate across Deloitte. This network was established in 2022 and is a platform for climate enthusiasts sharing experiences amongst likeminded people, providing ideas to leadership and helping spread information about sustainability at Deloitte. They do so, for example, by promoting the Sustainability Delivery Framework and GiKi tooling in their respective business areas. Despite our efforts, adoption of both SDF and GiKi throughout our firm can and should be further improved. The Climate Champions gather in person on a quarterly basis and are connected on an ongoing basis through online channels.

Furthermore, our people can connect internally and externally with sustainability related interest groups to expand their networks, learn about sustainability and how to integrate this in their personal and work life. Examples are the Growing Green Leaders and the Net Positive Network. Additionally, we have various online tools and learnings available to educate all our people on sustainability, including a learning catalogue, an internal website in which our people can find support towards sustainable leadership and how to deliver our work in a more sustainable way, the Sustainable Delivery Framework and GiKi Zero.

In close collaboration with the Rijksuniversiteit Groningen (RUG), we developed and offer a 2,5-day learning programme to equip our Partners and Directors with a sufficient level of sustainability knowledge to engage with clients on their sustainability journey. Last year, we conducted the third and fourth editions of this programme, training about 50 people. For the first time, we also invited clients to join the training sessions. We also held extensive CSRD trainings for senior consultants to senior managers and for partners and directors. More junior colleagues can participate in the NSE Sustainability Bootcamp, Springtij, the sustainability walking tours, the sustainability café, and the Sustainability Learning Platform or other opportunities for live learnings.

16 -20 October Global Sustainability learning week

In October 2023, DTTL hosted Sustainability learning week. In The Netherlands, we participated in this initiative by sharing the content, learning journeys and webinars. In addition we organised a screening of the documentary ‘Beyond Zero’ in cinema Pathe Tuschinski. 115 colleagues joined the screening, followed by sessions from leadership. The event marked the kick-off of sustainability learning week.

November Sustainability Month

In November 2024, we put the spotlight on sustainability within Deloitte Netherlands. We ran an internal campaign focusing on our sustainability activities involving both our internal sustainability efforts, sustainability client projects and sustainability collaborations with the Deloitte Impact Foundation. Throughout the month, we have posted client stories, employee stories, NSE WorldClimate updates, a Giki challenge and a message from our sustainability lead. We used our internal communication channels to reach our colleagues. In addition, we organised an exhibition about our Curacao-based Mangrove reforestation project. The exhibition was shown in our offices in Amsterdam, Rotterdam and Utrecht.

November – January: No more disposable cups

From November 2023 to January 2024, we executed an awareness campaign to phase out our disposable paper cups. The campaign’s goal was to make our colleagues aware of the changes that were coming up and to motivate them to start bringing their own cup. In addition, in December we restricted access to paper cups to start making our colleagues familiar with the changes starting from January 1, 2024, the date that we removed all paper cups from our offices.

April Earth Month

In April 2024, we celebrated Earth Month at Deloitte. During this month, we ran a thorough campaign to emphasise how we are driving sustainability transformation within our organisation and beyond and teach our people how they can play a role in making lasting changes for a sustainable world. Activities included the NSE Sustainability Townhall and the Giki Earth Month Challenge. We published articles about our IT related sustainability initiatives, as well as an interview with Oscar Snijders, our Sustainability SGO.

GSC DIF day

Also in April 2024, we organised a Deloitte Impact Foundation (DIF) day for our Group Support Center (GSC) colleagues. For this Impact Day, we directed our attention towards our own internal sustainability challenges, objectives and targets. The main purpose of this day was to educate and engage as many GSC colleagues as possible on how their roles intersect with our environmental objectives, and how they can contribute to the bigger picture. Our GSC colleagues contributed to some of our objectives during workshops and activities, including further promoting the Sustainable Delivery Framework and Giki Zero and creating appealing communication outings on how colleagues can contribute to a more sustainable world.

Engage ecosystems

We are collaborating with clients, alliance partners, NGOs, industry groups, suppliers, and others to accelerate the sustainability transition.

Sustainability SGO

One of the biggest sustainability impacts we can have as an organisation is through the work we do with our clients. We have developed a sustainability SGO (previously MDM), which promotes an integrated approach to sustainability and a sustainable leadership mindset with regards to the delivery of our work with clients. We believe that the footprint of the work we do for clients in support of their transition to a more sustainable world, has increased exponentially this year.

Systemic challenges

With our clients, and through coalitions of the willing, we want to tackle and accelerate five of the most complex systemic challenges the world is facing today.

1. Accelerating the energy transition

The energy transition is one of the most significant transformations the Netherlands has seen in this generation. We are working to setting the transformation agenda and providing end-to-end support in helping clients defining and achieving their path to net-zero. Hydrogen is projected to play a key role in the future of energy. In The Netherlands, we have a global centre of excellence for hydrogen. This provides us with a key position in the energy transition globally.

2. Developing a sustainable food system

At Deloitte, we want to change how we grow, produce and consume food in the future. Our purpose is to drive the transformation of the entire food ecosystem by future proofing our clients and supporting them to align shifting nutritional needs within planetary boundaries. As part of this we are focusing on nature positive food systems, resilient & digital food supply chains, future of food production and zero food waste. We have set-up the Net Positive Network, a community of CEOs, business leaders, startups, opinion makers, experts and producers, all dedicated to revolutionising our food system and making a real difference by taking action on regenerative agriculture, food waste reduction and protein shift. This year, the Network hosted Net Positive Dinners, organised the second round of the Spring Parade (summit with 350+ young talent from the food ecosystem) and continued to operate the Young Academy (immersive learning program to become a net positive leader), to name a few activities.

3. Building a circular world

We are working to embed circularity into all industries and building sustainable and resilient supply chains. As part of our activities, we are partnering with Circle Economy Consulting, an impact consulting firm with whom we seek to drive systemic change by investigating tangible solutions and opportunities for collaboration between the private and public sectors to help analyse, shape and deliver circular solutions that deliver commercial, sustainable and societal value. For the second consecutive year we have collaborated with Circle Economy Foundation to create the Circularity Gap Report, which has provided crucial analysis and theory on the global state of circularity since 2019.

4. Nature positive business and society

Governments, clients, and competitors are taking significant actions to halt and reverse nature loss. Deloitte is committed to create a nature positive business and society throughout our own operation and business model and by collaborating with stakeholders and NGOs to increase awareness and knowledge on nature.

As part of our activities, we collaborated with WWF-NL and Rabobank on building knowledge and sharing experiences on nature-related disclosures using the Taskforce on Nature-related Financial Disclosures (TNFD) Framework. We have achieved this by bringing together industry stakeholders during three events in 2023 and continuing in 2024 with a TNFD Working Group. The TNFD working Group includes both financial service industry and corporates. Additionally, as part of our cooperation with WWF-NL, we are working on a follow-up of the "Nature is Next" research that was published in 2022. This study addresses how companies are currently integrating nature and biodiversity into their business operations. Based on the findings we will develop guidance and recommendation with practical examples, challenges, opportunities and solutions. Furthermore, we are supporting the Science Based Targets Network (SBTN) and the Accountability Accelerator with a data architecture and technology platform for validating the first science-based targets for nature, so that companies can comprehensively address their environmental impacts, first on land use and freshwater, later followed by impacts on oceans.

We have also launched a Private-Public sector Partnership (PPP) to assess biodiversity-related risks and opportunities for the financial sector. Wageningen University and Research (WUR) researchers led by Wageningen Economic Research and the Foundation for Sustainable Development (FSD) together with six private partners from the financial sector and Deloitte as lead private partner, will develop a state-of-the-art methodology for biodiversity impact assessments. The 'Biodiversity Related Risks and Opportunities to the Financial Sector' project is a groundbreaking initiative addressing a critical gap in biodiversity financing. Now, more than ever, the financial sector needs robust tools to understand and mitigate the impacts of biodiversity loss. This PPP's unique approach aligns science-based future biodiversity and financial scenarios, utilising advanced economic modelling techniques to provide comprehensive monetary estimates of biodiversity effects on the economy at the country and sector levels.

See Chapter 5.1 Nature and biodiversity for more information on our nature approach.

5. Achieving Climate Equity and a Just Transition

The transition to a net-zero economy does not impact all communities equally, and a just transition requires fairness, equity, and inclusion to be placed at the forefront of climate action. We help our clients evaluate the uneven impact of the transition, manage systemic risk, and harness opportunities to deliver value to their stakeholders.

Sustainability partner groups

Deloitte is a member of:

-

Green Business Club

-

UNGC, Board of Directors, and Peer Learning Groups for Climate, Human Rights and Diversity.

-

MVO Nederland

Other systemic transformation networks

For the second time this year, Deloitte co-hosted the Growing Green Leaders event with three other companies. About 50 young professionals from each of the articipating companies attended the event, with the aim to better understand the challenges and dilemmas that businesses face in the context of the climate and sustainability crisis, and how they can contribute to change.

Suppliers

We are engaging with our major suppliers with the goal of having two-thirds of them adopt science-based targets for carbon reduction within five years. We are off-track for our target to reach 67% by 2025, and were on 20% in 2022/2023. We believe that the large number of suppliers to reach, their varied strategies towards carbon reduction, as well as the lengthy timeline needed to set and verify SBTs are contributing factors to our result. To regain momentum, we have increased our efforts to engage with our suppliers on this topic and are rolling out a renewed work programme to reach our target. We are actively approaching all our largest suppliers and are offering webinars "Setting SBT information for Deloitte suppliers" to educate suppliers on our expectations and the SBTi journey. We have also initiated the NSE Procurement Roundtable, which is a Deloitte NSE-wide platform on the establishment of shared sustainable procurement policies and tools going forward.

Results

We made the following considerations when determining which Scope 3 emissions are relevant to Deloitte:

Description | Consideration | Conclusion |

Purchased goods and services | Is material on the basis of our spend | Included |

Optional sub-category: Cloud computing and data centre services | Is part of Purchased goods and services | Excluded |

Optional sub-category: Capital goods | Deloitte is asset-light hence emissions are limited | Excluded |

Fuel and energy-related activities | Not applicable to Deloitte | Excluded |

Upstream leased assets | We rent our offices and are not in control in most of them for heat and power | Included |

Waste generated in operations | Waste generated is very low and therefore not deemed material | Excluded |

Processing of sold products | We do not process sold products | Excluded |

Use of sold products | We sell services and not products so not applicable | Excluded |

End-of-life treatment of sold products | We sell services and not products so not applicable | Excluded |

Downstream leased assets | We have no downstream leased assets | Excluded |

Franchises | We have no franchises | Excluded |

Upstream transportation and distribution | As we do not process or sell products, there is no upstrean transportation and distribution | Excluded |

Downstream transportation and distribution | As we do not process or sell products, there is no downstream transportation and distribution | Excluded |

Business travel | Business travel is a significant part of our GHG emissions | Included |

Employee commuting | With over 8,000 employees, employee commuting has the potential of being a significant source of GHG emissions | Included |

Financial investments | We do not have financial investments | Excluded |

Table 07: Total Greenhouse Gas Emissions per scope

Retrospective | Base year** | |||

2023/2024 | 2022/2023 | 2018/2019 | Δ previous year (%) | |

Scope 1 GHG emissions | ||||

Gross Scope 1 GHG emissions (tCO2eq) | 6,668 | 9,042 | 15,046 | -26.3% |

% of Scope 1 GHG emissions from regulated emission trading schemes (%) | 0 | 0 | 0 | 0.0% |

Scope 2 GHG emissions | ||||

Gross location-based Scope 2 GHG emissions (tCO2eq) | 3,900 | 4,174 | 4,921 | -6.6% |

Gross market-based Scope 2 GHG emissions (tCO2eq) | 3,113 | 3,346 | 3,524 | -7.0% |

Significant scope 3 GHG emissions | ||||

Purchased goods and services | 5,547 | 33,318 | 17,244 | -83.4% |

Upstream leased assets | 318 | 1,279 | N/A | -75.1% |

Business travel | 7,293 | 5,832 | 11,889 | 25.1% |

Employee commuting | 108 | N/A | N/A | N/A |

Working from home | N/A | N/A | N/A | N/A |

Total scope 3 GHG emissions | 13,266 | 40,429 | 29,133 | -67.2% |

Total GHG emissions (location-based) (tCO2eq) | 23,833 | 53,645 | 49,100 | -55.6% |

Total GHG emissions (market-based) (tCO2eq) | 23,046 | 52,817 | 47,703 | -56.4% |

* We have selected 2028/2019 as our base year as this is the last year that was unaffected by the restrictions during the COVID pandemic and was therefore selected by DTTL as the baseyear for the WorldClimate strategy. We believe that 2018/2019 still is a valid year to measure progress against.

There is a considerable decrease in our reported Scope 3 Purchased Goods & Services emissions. These emissions are calculated by DTTL and NSE and will become final at a later date. The emissions figure we have included is based on preliminary data supplied by the DTTL team. In 2023/2024, significant data quality improvements took place, allowing for better determination of actual cost incurred for PG&S. Notably, Deloitte has transitioned to an activity-based emissions calculation methodology for contingent labour, focusing on the carbon-generating activities of contractors, such as business travel, commuting, and working from home, instead of using spend (which is also included the hourly rate charged for services delivered) as a proxy. For more detail, see the Basis of Reporting.

Table 08: Greenhouse gas intensity*

2023/2024 | 2022/2023 | 2018/2019 | Δ FY24 vs FY23* | |

GHG intensity per net revenue | ||||

Total GHG emissions (location-based) per net revenue (tCO2eq/1,000 euro) | 0.017 | 0.039 | 0.051 | -56.4% |

Total GHG emissions (market-based) per net revenue (tCO2eq/1,000 euro) | 0.017 | 0.039 | 0.049 | -56.4% |

* Greenhouse gas intensity is calculated using 'Revenue' as included in the 'Consolidated statement of profit or loss and other comprehensive income for the year ended May 31, 2024' in Annex 1 of this report.

Table 09: Housing

2023/2024 | 2022/2023 | |||

Scope 1 thermal energy consumption | 1,364 | GJ | 1,674 | GJ |

Scope 2 energy consumption | 2,703,388 | kWh | 2,790,557 | kWh |

- renewable sources | 2,398,693 | kWh | 2,457,724 | kWh |

- non-renewable sources or unknown | 304,695 | kWh | 332,833 | kWh |

Scope 3 energy consumption | 9,543,519 | kWh | 9,668,080 | kWh |

- renewable sources | 8,280,943 | kWh | 5,422,284 | kWh |

- non-renewable sources or unknown | 1,262,576 | kWh | 4,245,795 | kWh |

Specific electricity consumption | 115.34 | kWh/m2 | 110.0 | kWh/m2 |

Specific thermal energy consumption | 0.23 | GJ/m2 | 0.242 | GJ/m2 |

* We have restated our Housing data for 2022/2023 as a result of the introduction of an improved and more accurate methodology. The numbers reported in this table better reflect the energy consumed in our offices.

Table 10: Mobility

2023/2024 | 2022/2023 | |||

Number of lease cars | 3,781 | 3,409 | ||

- electric cars (incl. plug-in hybrids) | 2,444 | 1,725 | ||

Total kilometres travelled by leased cars | 105,475,890 | 122,656,112 | ||

Total emissions fossil fuels (Scope 1) | 6,585 | t | 8,957 | t |

Total emissions electric cars (Scope 2) | 3,086 | t | 3,315 | t |

Total kilometres travelled by air | 21,052,928 | km | 22,163,371 | km |

Total emissions air travel (Scope 3) | 6,173 | t | 4,800 | t |

Total emissions air travel per FTE | 793.6 | g CO2/FTE | 622.8 | g CO2/FTE |

Total hotel nights | 36,313 | 35,910 | ||

Total emissions hotels (Scope 3) | 1,115 | t | 1,002 | t |

Total kilometres international rail travel | 909,368 | km | 8,736,978 | km* |

Total emissions international rail travel (Scope 3) | 5 | t | 30 | t* |

Total kilometres employee commuting | 13,443,132 | km | N/A | km |

Total emissions employee commuting (scope 3) | 108 | t | N/A | t |

Total mobility related CO2 emissions | 17,071 | t | 18,104 | t |

Total mobility CO2 emissions intensity | 121.2 | g CO2/km | 117.9 | g CO2/km |

*The 2022/2023 figure includes national rail. In 2023/2024 national rail is included in Employee commuting.

The firm recognises that there are currently no performance-related metrics for climate in place outside the Executive Board . In addition, an internal carbon pricing framework has not been set. However, in close cooperation with DTTL and NSE, the implementation of such policies and frameworks are being considered for future reporting periods.

Mobility

As described above, by December 31, 2025, all lease contracts for fossil fuel leased cars will have ended and we will meet our target of a 100% electric fleet. We do, however, note that the traceability of the power sources used for our electric cars is limited. We will be working on increasing traceability for types of energy used for our electric cars going forward with the goal of increasing the share of renewable energy in the electricity mix that powers our fleet.

Business Travel

We will further evolve in our business travel monitoring activities, enhancing our reporting against target with leadership in the coming reporting year. This will enable us to manage and steer our business travel related emissions more accurately, ensuring that we will continue to stay within a 50% reduction compared to our base year on the longer run. We also aim to facilitate monitoring of engagement related emissions.

Housing

We will end the lease in Eindhoven and move to a new non-gas office by the end of 2025.

IT strategy

We are looking into the potential IT related sustainability challenges for the future. One example is how Deloitte plans to deal with AI on a sustainability level. AI uses a significant amount of data, making it energy-intensive to host. We are investigating the impact of AI on total energy consumptions and how to mitigate a possible increase of emissions in our supply chain.

Procurement:

We will work to enhance environmental and social outcomes through our procurement practices. We plan to adopt and implement a responsible procurement policy to help us meet our business needs in a manner that delivers on our WorldClimate objectives and actively contributes to tackling the broader environmental and social challenges we collectively face.

2.2 Other environmental information

In this section, we disclose information about our generation and disposal of waste. We choose to do so because there is a clear connection between carbon emissions reduction and the prevention and recycling of waste. Although we do manage waste, we have not set targets for reduction or recycling yet as we do not deem our impacts as a result of waste management to be material at present.

In terms of activities, we have implemented our reusable cup strategy in January 2024. This means that we no longer use single paper cups in the Deloitte offices. This change is a positive step for the environment that aligns with the Deloitte sustainability strategy, as well as the Single Used Plastic (SUP) legislation. People are bringing their own reusable cups and for visitors we provide either porcelain/glass coffee cups, or the sustainable Huskee cup. To date, we have saved about one million paper cups and prevented over 4,000 kg of waste.

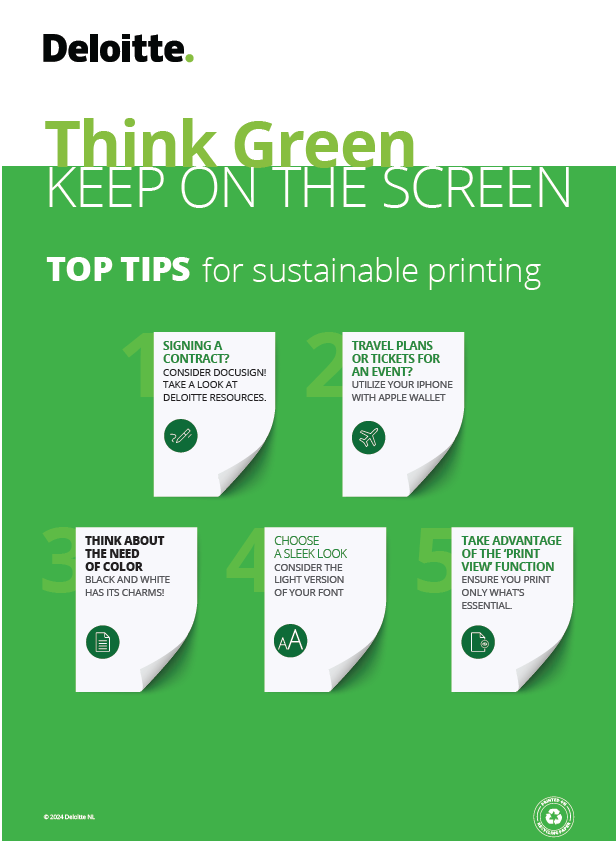

We have also reduced the number of printers available in our offices by 35 devices (from 105 to 70), a reduction of 33% and we have rolled out the printing campaign "Think Green, Keep on the Screen." This campaign aims to reduce our overall print volume, reminding our employees to print only when needed. This campaign has been rolled out in our Dutch offices.

Table 11: Waste

2023/2024 | 2022/2023 | |||

Total waste generation | 206 | t | 211 | t |

- waste offered for recycling | 58 | t | 59 | t |

- waste offered for landfill | 0 | t | 0 | t |

- waste offered for incineration | 148 | t | 152 | t |

- hazardous waste | 0 | t | 0 | t |

Waste recycling as % of total waste | 28 | % | 28 | % |

Waste intensity per turnover | 0.00015 | t/€1,000 | 0.00016 | t/€1,000 |