About Deloitte

Deloitte Netherlands is the Dutch firm of Deloitte North and South Europe (NSE) and as such is a separate and independent legal entity. Deloitte Netherlands operates in the Netherlands and in the Dutch Caribbean. For a full list of subsidiaries, please see Notes 4. Consolidated Group companies of the Company finanical statements in Annex 1.

Headcount of Deloitte in the Netherlands and the Dutch Caribbean

Male | Female | Other/Non-disclosed | Total | |

Deloitte Netherlands | 4,614 | 3,496 | N/A | 8,110 |

Deloitte Dutch Caribbean | 32 | 54 | N/A | 86 |

Total | 4,646 | 3,550 | N/A | 8,196 |

In the Netherlands, we employ more than 8,100 people (excluding contractors) in 16 different offices around the country. This makes us one of the leading Dutch professional services providers in the areas of audit and assurance, tax and legal advisory, consulting, risk advisory and financial advisory. Our practitioners work in multidisciplinary teams to help resolve our clients challenges and realise opportunities.

As of March 1, 2024, Deloitte has acquired the Dutch dialogue marketing agency CloseContact that boasts over 15 years of experience in data-driven communication and marketing automation, particularly in Salesforce Marketing Cloud (SFMC).

Deloitte NSE

Deloitte NSE brings together around 75,000 professionals. Together, we make an even greater impact in each of our markets. By working as a unified firm and leveraging our combined network, we can achieve more – for our clients, our people and the communities we work in. As an organisation that advises and audits organisations across industries and sectors around the world, ours is a business built on trust.

Deloitte NSE comprises the following 30 countries: the Netherlands (incl. Deloitte Dutch Caribbean), the UK & Switzerland, Ireland, Belgium, Finland, Denmark, Sweden, Norway, Iceland, Italy, Greece, Malta, Gibraltar, Libya, Palestinian ruled territories, Cyprus, Lebanon, Jordan, Iraq, Egypt, Saudi Arabia, Kuwait, Bahrain, Qatar, the Republic of the Sudan, the United Arab Emirates, Oman and Yemen.

Deloitte Global

Our global organisation has grown in scale and diversity and now comprises approximately 457,000 people in more than 150 countries and territories, serving nearly 90% of Fortune Global 500® companies and almost all the Amsterdam Exchange Index companies, providing assurance services or, to non-audit clients, advisory services. We believe our professionals deliver measurable and lasting results that help reinforce public trust in capital markets, enable clients to transform and thrive, and lead the way towards a stronger economy, a more equitable society and a more sustainable world.

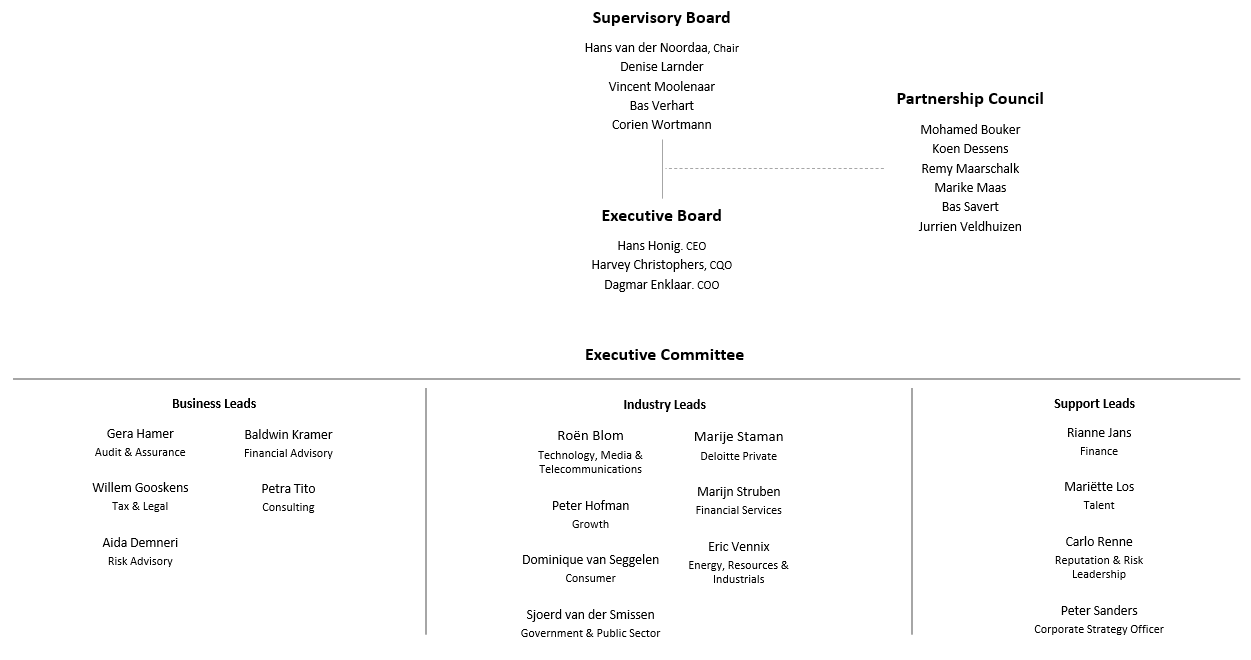

Our leadership in 2023/2024 (per May 31, 2024)

Our leadership structure consists of a Supervisory Board, Executive Board and Executive Committee. Please see below an overview of the members.

Effective October 1, 2024, we will implement changes to our structure. They will be not only be implemented to Deloitte NL, but across Deloitte globally. From this date onward, we will serve our clients through four businesses:

-

Audit & Assurance (Business Lead: Gera Hamer)

-

Tax & Legal (Business Lead: Willem Gooskens)

-

Strategy, Risk & Transaction Advisory (Business Lead: Baldwin Kramer)

-

Technology & Transformation (Business Lead: Petra Tito)

We implement these changes to enhance our international alignment, thereby improving our capabilities to help our clients in maneuvering through a fluctuating global environment.

Business results

Revenue shows a stable growth at 2.5% this fiscal year despite challenging market conditions, particularly in parts of our advisory business. This modest growth is attributed to the positive performance across most business lines, with the exception of Consulting, which experienced a slight decline compared to the previous year. The utilisation of our Global Delivery Network (GDN) has increased, aligning with our strategic objectives and compensating for the steady headcount in client-serving roles.

In our Audit & Assurance business, we continue to see a positive trajectory in revenue. However, our Consulting practice faced headwinds, experiencing a decrease in revenue and a slight contraction in workforce. In Financial Advisory there is stable performance Risk Advisory showed a revenue growth around 5%. The Tax & Legal business shows a solid growth, with certain areas achieving double-digit growth. Collectively, these performances depict a mixed but promising landscape, with areas of both challenge and opportunity that require tailored strategic focus to optimise growth and profitability. Our result before tax and management fees amounted to €159.7 million (2022/2023: €164.8 million).

As a percentage of revenues, our result before tax and management fees decreased to 11.5% from 12.1% in 2022/2023. We continue to invest in our employees to attract and retain talent. As a result, our salary costs have increased due to continued improvements of our Employee Value Proposition. The variable compensation increases from €31.6 million in 2022/2023 to €46.6 million in 2023/2024. At the end of our fiscal year, the size of our client serving staff is comparable to last year. As was the case last year, lower productivity levels impacted our revenues and this continues to have our attention. At the start of the fiscal year, we noted our increased cost levels were exceeding the growth in our business performance. During the year, we have taken measures to improve our operational cost levels and meet our targets for the fiscal year.

Solvency and liquidity

Solvency based on equity, membership capital and subordinated loans (Group’s capital base) is 23.3% (20.6%). The improved solvency is the result of the received additional subordinated loans provided by our partners. Our liquidity has also improved: our year-end cash balance increased to €108.0 million. During the year, we have not used our credit facilities and we are in compliance with our covenants. Our working capital, defined as the sum of unbilled services, advanced billings and accounts receivable, improved with € 20.9 million to a total of €320.9 million at year end. This is the result of management’s continuous focus on improving working capital and reducing the balance of unbilled services.

For a full overview of and detailed notes to our financial performance, please see the Financial Statements, which are annexed to this report.

Taxation

As a responsible business, our policy is to comply fully with both the letter and the spirit of Dutch tax legislation. To enhance our transparency on this topic, we have adopted a Tax policy, that can be found in the Annexes of this report. Our Tax policy addresses the three main types of national taxation that are applicable to us: corporate tax, tax on wages and value added tax.

To ensure Deloitte’s compliance with all laws and regulations, regular meetings with Dutch Tax Authority (DTA) are scheduled to pro-actively discuss our questions and potential issues for all three mentioned taxes.

Furthermore, we annually perform a randomly selected sample test in our financials (outgoing payments) to test the compliance of the relevant tax aspects. The DTA is involved throughout this process and receives an integral report on findings and identified improvements.

Corporate tax

Deloitte’s partners/owners charge Deloitte a management fee through a personal management company. These management fees - after deduction of, amongst other costs, a so-called customary salary for the partner - are fully taxable at the level of the individual management company, in accordance with the regular Dutch corporate income tax rates. Deloitte’s remaining profit is taxable at Deloitte level, also subject to the regular Dutch corporate income tax rates.

Wage tax

All relevant filings are submitted timely and in accordance with Dutch rules and regulations.

All cross-border work situations (including secondments, projects and expatriates) are handled by a dedicated group of specialists in the Netherlands as well as abroad, to ensure that Deloitte and its employees meet all Dutch and local requirements.

Value added tax

On all incoming and outgoing transactions, we follow the rules and guidelines for value added tax (VAT). Specific transactions, such as invoices within or outside EU and invoices for exempt services, are subject to strict protocols to ascertain that VAT is reported correctly.