1. Basis of preparation

Introduction

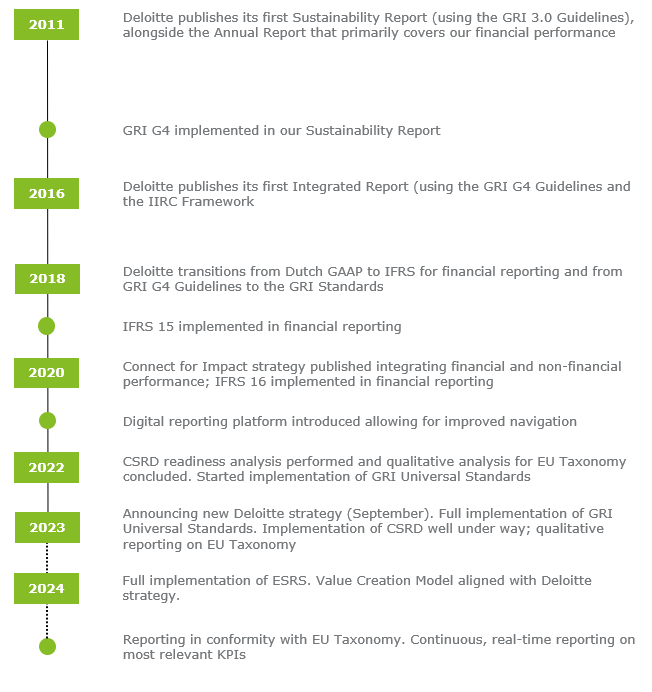

This Report has been prepared in accordance with the European Sustainability Reporting Standards (ESRS) as set out in the Annex 1 to the Commission Delegated Regulation (EU) 2023/2772 of 31 July 2023 supplementing Directive 2013/34/EU of the European Parliament and of the Council. An ESRS Content index is included in this report (see pages 200-211). In this table, we provide an overview of our compliance and non-compliance with the ESRS. As Deloitte is a member of UN Global Compact the Netherlands, we connecy our impacts with the UN Sustainable Development Goals that we deem most relevant to Deloitte.

Deloitte aims to be at the forefront of public reporting and has a long-standing practice of voluntarily disclosing audited, financial and non-financial information. Reporting to us is an evolutionary process where every year, we aim to improve on what we have done before and implement the latest reporting insights and requirements.

Disclosures incorporated by reference

The following information is incorporated by reference to other parts of the management report:

-

The role of the administrative, management and supervisory bodies (ESRS 2 GOV-1): Roles and responsibilities, Report of the Supervisory Board, Profile Supervisory Board Deloitte Netherlands;

-

Information provided to and sustainability matters addressed by the undertaking’s administrative, management and supervisory bodies (ESRS 2 GOV-2): Report of the Supervisory Board;

-

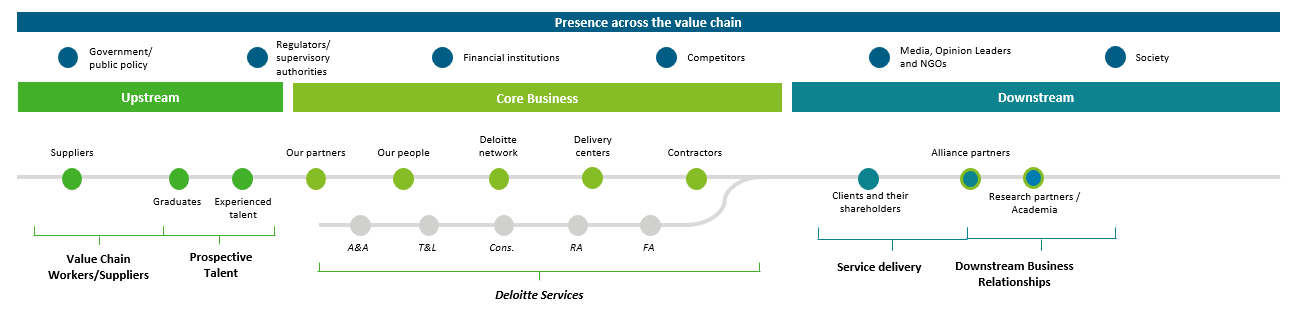

Strategy, business model and value chain (ESRS 2 SBM-1): Our businesses and industries, About Deloitte, Our purpose and strategy, Our strategy in action, Value creation;

-

Interests and views of stakeholders (ESRS 2 SBM-2): Our strategy in action;

-

Material impacts, risks and opportunities and their interaction with strategy and business model (ESRS 2 SBM-3): Value creation model, Our Purpose and Strategy;

-

Description of the process to identify and assess material impacts, risks and opportunities (ESRS 2 IRO-1): Risk Management;

-

Disclosure Requirements in ESRS covered by the undertaking’s sustainability statement (ESRS 2 IRO-2): ESRS Content Index (Annex 3).

The Executive Board and Supervisory Board are actively involved with the execution of our business and strategy. Impacts, risks and opportunities related to our business and strategy, such as our Employee Value Proposition, Diversity, equity and inclusion, Learning & development, Quality, and Climate and CO2, are frequently discussed between the topic owners and the Board. For some other material topics, there is periodic quantitative and qualitative reporting (such as DIF and Social return). For Ethics & integrity, all reported cases are discussed with the Executive Board. Data security (including privacy) is discussed with the Board when needed (for example in the case of major incidents).

The evolution of our reporting

EU Taxonomy

Following the EU Taxonomy, Deloitte will be required to report the percentage of eligible and aligned turnover, CAPEX, and OPEX (contributing to the six environmental objectives from the EU Green Deal) for our financial year 2024/2025. To this end, we have identified the eligible and possibly aligned activities contributing to the first two environmental objectives of as part of future reporting.

In general, the main areas of our revenue comes from providing professional services that are not classified as 'eligible turnover' by the EU Taxonomy. An exception is activity 9.3 ‘Professional services related to energy performance of buildings’ as Deloitte is an accredited auditor for the energy performance of buildings, and provides performance assessments for real estate clients. This is, however, a relatively small part of our total revenue.

The most notable eligible capital expenditure (CAPEX) refers to the lease of our buildings, classified under the activity 7.7 “Buying real estate and exercising ownership of that real estate”, as four of our buildings in the Netherlands have at least an Energy Performance Certificate (EPC) class A.

The most notable eligible operating expenditure (OPEX) refers to Activity 6.5 ‘Transport by motor bikes, passenger cars, and light commercial vehicles’, as a substantial amount of the passenger cars leased by Deloitte have tailpipe CO2 emissions equal to 0g CO2 e/km.

We present an overview of eligible activities that we have identified below:

OPEX and CAPEX

-

6.5. Transport by motorbikes, passenger cars and light commercial vehicles (OPEX)

-

7.7. Acquisition and ownership of buildings (CAPEX/ OPEX)

-

1.1 Afforestation (OPEX)

-

1.3 Forest management (OPEX)

-

6.4. Operation of personal mobility devices, cycle logistics (OPEX)

-

5.5. Collection and transport of non hazardous waste (OPEX)

-

7.2, 7.3, 7.5, 7.6. Renovation of buildings, maintenance of energy efficiency equipment, energy performance devices, renewable energy technologies (CAPEX/ OPEX)

-

7.4. EV charging stations in buildings and parking spaces (CAPEX/ OPEX)

-

8.1. Data processing, hosting and related activities (OPEX)

-

11.1. Education (OPEX)

Revenues

-

8.2. Computer programming, consultancy and related activities

-

9.1. Engineering activities and related technical consultancy dedicated to adaptation to climate change

-

9.1. Close to market research, development and innovation

-

8.2. Data driven solutions for GHG emissions reductions

-

9.2. Research, development and innovation for direct air capture of CO2

-

9.3. Professional services related to energy performance of buildings

-

11.1. Education

In 2024/2025, in close cooperation with other Deloitte geographies in the European Union, we will assess whether these activities can be aligned. One of the elements we need to investigate further is the ability for our systems to generate sufficient and reliable data on the activities now identified. In addition, we will continue to work towards strengething compliance with the minimum safeguards as required by the EU Taxonomy regulation.

1.1 Scope

In this Report, ‘Deloitte’ refers to Coöperatief Deloitte U.A. and its subsidiaries as listed in the ‘Notes to the specific items on the financial statements’ in Annex 1. The performance of Deloitte Dutch Caribbean (DDC) is integrated in our non-financial data, unless otherwise indicated.

For the purpose of this report, we apply the following definitions regarding the scoping of time:

-

Short-term: one year;

-

Middle-term: one to four years (in line with our strategic planning cycle);

-

Long-term: over four years.

1.2 Materiality

Process to assess materiality

The starting point of our materiality assessment is the long list with the Sustainability matters covered in topical ESRS. We assess these topics for potential material impacts, risks and opportunities throughout our value chain and on that basis, decide which matters deserve further consideration. To this list, we add the matters that come out of our peer benchmark analysis, thus creating a short-list. To identify matters material to Deloitte, we consult with our stakeholders. While this occurs during our materiality assessment, we regularly engage with them throughout the year as well. Sometimes, our engagement involves desk research, such as reviewing the material topics relevant to our industry peers. The methods of our stakeholder engagement are detailed in the table below. These interactions offer valuable perspectives on the environmental, social, and governance issues that shape stakeholders' perceptions of us.

Once we have an initial idea of possible topics to be included in our materiality assessment, we seek input from our due diligence process owners. Specifically, we interact with our Client & Engagement acceptance teams, our Business Relationship Assessment team and the Responsible Business Committee. On the basis of our stakeholder engagement and the input from our due diligence processes, we define a shortlist of expected sustainability impacts, risks and opportunities. The impacts are assessed through a Strategic Impact Assessment, where the social cost per impact is calculated to determine the scale and scope of the impacts and facilitate ranking. We use social impact as this methodology assesses the full social costs across and beyond our value chain and takes aspects such as remediability of impacts into account. In addition, it makes various impacts comparable as it monetises them. We believe that using social impacts is in line with our purpose 'To make an impact that matters'. Impact materiality occurs when calculated social costs are greater than €25 million, representing around 2% of our revenues.

Consequently, we seek to connect the sustainability matters with our Enterprise Risk Framework. Impacts that are part of the ERF (such as Quality and Ethics & integrity) are plotted directly in our materiality assessment on the basis of the exposure as defined in our Risk Radar (please see pages 50-51). For topics that are not part of our Risk Radar, we interact with the topic owners to determine and quantify associated risks and opportunities. To this end, we plot risks and opportunities on financial impact and likelihood. The threshold value for financial impact is the same as for impact materiality. The outcome of this process is used to plot the topics against both impact and financial materiality.

On the basis of this representation, a defined list of key material impacts, risks and opportunities is proposed to the Executive Board and, after their approval, shared with our Supervisory Board.

Stakeholder interaction

We interact with our stakeholders to seek their opinions and their expectations. This process allows us to define a timely and adequate response to the issues they deem important for our business and for our ability to make an impact that matters.

Graph: Stakeholders in our value chain

Table 01: Means of stakeholder engagement

Stakeholder groups | How we seek their interest and views | Frequency |

Clients & their shareholders* | Client Service Assessments | Continuous |

Engagement quality assessments | Continuous | |

Client meetings and (digital) events | Continuous | |

Requests for proposals | Continuous | |

Clients & Industries research | Continuous | |

External research and ratings | Continuous | |

Media scanning | Continuous | |

Our people* | Talent surveys | > 6 times per year |

Sustainability survey and focus groups | Bi-annually | |

Discussions with Works Council | ||

Formal and informal meetings, including virtual townhalls | Continuous | |

Feedback / comments from individuals | Continuous | |

Our partners* | Formal and informal partner meetings | |

Partner strategy sessions | Annually | |

Partnership Council | ||

Receiving feedback | Continuous | |

Graduates and experienced talent* | Surveys and research | Continuous |

Job interviews | Continuous | |

LinkedIn profiles | Continuous | |

Participation in campus events | Continuous | |

Recruitment sessions | Continuous | |

Deloitte network* | Active participation in key DTTL and NSE governance bodies | Continuous |

International cooperation around issues or engagements | Continuous | |

Regulators* | Formal and informal meetings | > 4 times per year |

Media scanning | Continuous | |

Media, Opinion leaders & NGOs | One-on-one engagements | Throughout the year |

Cooperation with knowledge institutes such as universities | Continuous | |

Media scanning | Continuous | |

Society* | Active participation of Deloitters in society | Continuous |

Media scanning | Continuous | |

Peers | Active participation in trade and industry platforms | Continuous |

One-on-one sessions around themes or issues | Throughout the year | |

Media scanning | Continuous | |

Suppliers* | Contract management | > once per year |

Media scanning | Annually | |

Financial institutions* | One-on-one meetings | Regularly, when needed |

Media scanning | Continuous |

- * Indicates a stakeholder that is affected by Deloitte activity in one or more material sustainability matters

Downstream Business Relationships are not yet in scope of our structured stakeholder engagement and are, therefore, excluded from our materiality assessment. We will work to obtain relevant insights in 2024/2025 and will include their perspectives in the update of our DMA that we will prepare for our 2024/2025 reporting.

Following our extensive stakeholder dialogue in 2022/2023, this year we have updated our insights whereby we have focused on the following stakeholder groups:

-

Clients and their shareholders

-

Deloitte network

-

Peers

-

Media, Opinion leaders & NGOs

-

Financial institutions (banks)

-

Suppliers

-

Graduates and experienced talent

For the stakeholders listed above, we provide an overview of the insights that we gained for updating our materiality matrix. For stakeholder groups not specifically engaged with on materiality in 2023/2024, we provide the conclusions of our 2022/2023 activities.

Our partners and our people

In February 2023, we conducted an internal sustainability survey in which 422 of our partners and employees participated. One of the aims of this survey was to obtain better insights into the sustainability matters that our employees deem relevant to Deloitte. To assess their views as input for our (double) materiality analysis, we asked them to select the five topics where they believed Deloitte has the biggest impact. We also asked our people to select five topics they believed that have the greatest impact on Deloitte's operations, reputation and financial success in the short and medium term. Combining this inside-out and outside-in perspective, we came to the following list of topics our people believe are material for Deloitte:

-

CO2 emissions

-

Energy

-

Innovation

-

Data security

-

Ethics & Integrity

-

Vitality & wellbeing

-

Biodiversity

-

Quality

-

Social impact & social return

-

Economic growth

-

Inclusion & diversity

-

Sustainable procurement

Clients and their shareholders

Our clients turn to Deloitte for relevant insights and high quality professional services that help their businesses become more responsible and sustainable. Quality, in all its aspects, is the key driver for our success, as is our ability to quickly adapt to the changing needs of our clients regarding the expertise they seek from us. To ensure both quality and adaptability, continuous learning, development of our people, and the ability to innovate are key requirements, as is international cooperation to deliver high quality engagements across borders.

To perform our services, in many cases our clients entrust us with sensitive data. The integrity of our IT systems and the prevention of data leaks is of vital importance to the trust that our clients have in Deloitte. Privacy and data security are therefore highly important topics to us.

Larger corporate clients and public sector clients are especially aware that their responsibility reaches beyond their direct operations and also involves parts of their value chain. Typical topics that these clients are interested in are: climate impact and GHG emissions, environmental management and certification, human rights in general, labour rights, public commitments in the area of sustainability, and human trafficking and slavery.

Deloitte network

DTTL has its own process for determining materiality in accordance with the GRI Standards. The outcome of this process provides input for our materiality assessment. The material topics from DTTL relevant to their 2022/2023 reporting are depicted in the graph below:

Government / policy makers

We have formal and informal engagements with our regulators and public policy makers. The focus of our regulators/public policy continued to be on the following themes: quality (fraud, continuity), implementation of ISQM1, independence, learning, attractiveness of profession, IKO (the results of internal engagement quality reviews and results of system of quality review), use of data analytics and data-driven supervision.

Key themes for public policy work, financial health, digital and sustainability. In addition, policy makers expect Deloitte to contribute to the solution of complex social challenges and we experience a great interest in our 'Future of' agenda. For more information on our public policy activities, please see page 181).

Peers

We have benchmarked our material topics and related performance against eight (including Deloitte Netherlands) national and international peers on the basis of their most recent public reports. Material matters that were mentioned by the majority of our peers were:

-

Inclusion and diversity (8 mentions);

-

Data security (7);

-

Wellbeing (7);

-

Climate & CO2 emissions (7);

-

Quality of services (6);

-

Ethics & integrity (6);

-

Employee value proposition (6);

-

Learning and development (6);

-

Social impact (6);

-

Innovation (5).

Media, Opinion leaders & NGOs

We constantly monitor public opinion and actively scan media for emerging topics. Our efforts in 2023/2024 show that the following topics have the most hits on Google in relation to Deloitte: learning, inclusiveness and diversity, wellbeing, customer satisfaction, ethics, career development, environmental care, and climate.

Suppliers

In addition to our regular due dilligence activities vis-a-vis suppliers (also see "Sustainable procurement" on pages 188-189), we have launched an initiative in which we want to stimulate our suppliers to become committed to Science Based Targets for the reduction of greenhouse gasses. This initiative results in conversations with suppliers about sustainability matters which helps us to better understand impacts, risks and opportunities vis-a-vis our suppliers.

Graduates and experienced talent

By nature, our business is characterised by a high employee turnover and changing skill sets. Combined with the growth of our business, this means that we are constantly recruiting new talent. Deloitte's Global 2023 GenZ & Millennial Survey provides a wealth of insights into the desires and expectations from our (future) colleagues. Analysis of the Survey shows that the following topics are of specific interest to new hires:

-

High cost of living / employment / income

-

Work-life balance

-

Mental health

-

Work-related pressures

-

Harassment or microaggressions in the workplace

-

Visible climate action

-

Inclusiveness, diversity and equality

-

Social impact / purpose

-

Learning / development opportunity

-

Hybrid working

-

Healthcare / disease prevention

The stakeholder groups that are not included in the overview above, were not in scope for this year's reporting as we deemed our sustainability impact on them not likely to be material or not sufficiently attributable. We will re-assess our choices in this respect in 2024/2025.

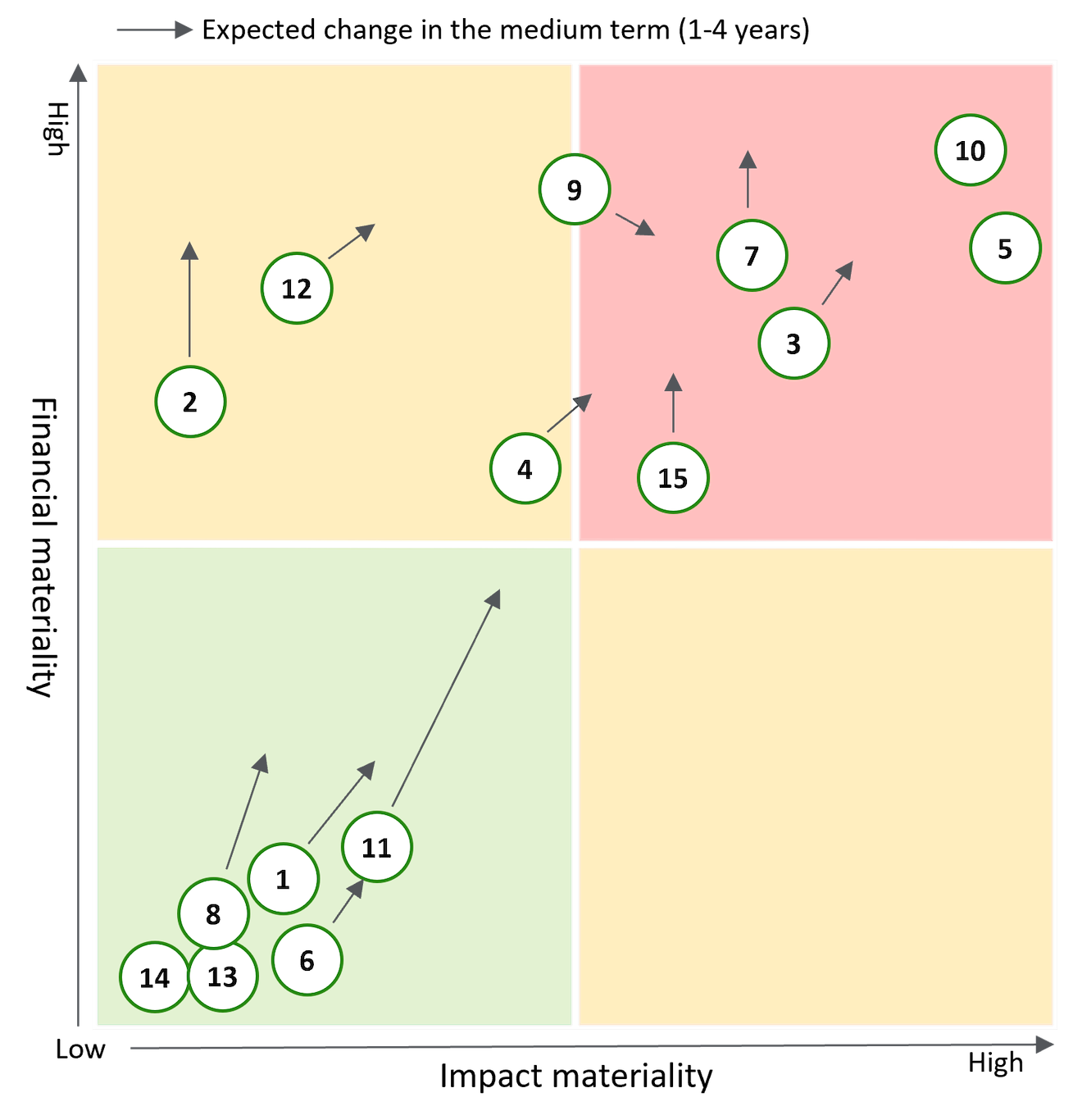

Assessing impacts

After identifying relevant topics, we have assessed the actual and potential impacts of the topics both from an inside-out and an outside-in perspective. For the sake of this materiality assessment, financial materiality includes reputational materiality as defined in our Enterprise Risk Framework (ERF). Topics that are not included in our ERF have been subject to their own assessment of risks and opportunities for the short (<1 year), medium (1-4 years) and long (>4 years) term. We disclose the associated risks and opportunities for each material impact in sections 2-4 of Annex 2. Impact materiality has been determined by the Strategic Impacts Assessment (SIA) that was performed in 2023 based on our 2021/2022 data, and that will be updated in 2024/2025. We have assessed the following topics (in alphabetical order):

① Biodiversity

② Climate and CO2

③ Data security (incl. privacy)

④ Diversity, equity & inclusion

⑤ Employee value proposition

⑥ Energy transition

⑦ Ethics & integrity (incl. corruption)

⑧ Human rights

⑨ Learning & development

⑩ Quality

⑪ Responsible supply chain

⑫ Social impact & social return

⑬ Waste

⑭ Water

⑮ Well-being

Graph 01: materiality assessment

Consequently, we have discussed our selection with internal experts in the area of sustainability and impact. In March 2024, we presented our conclusions to the Executive Board, which has ultimately determined the material topics for our financial year 2023/2024.

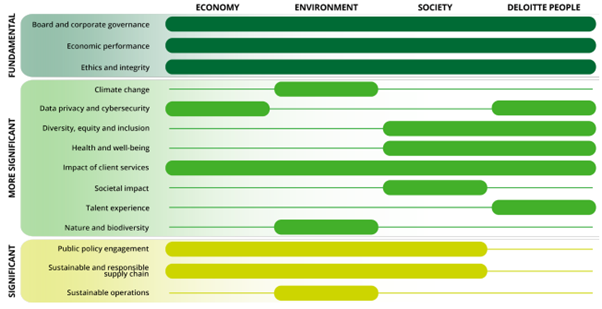

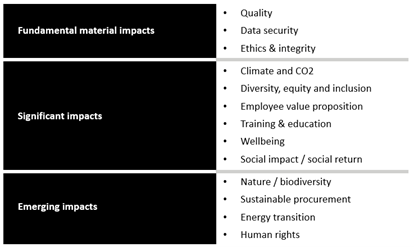

Fundamental material impacts are those that are overarching requirements that we must meet in order to establish trust, strengthen market leadership and make an impact on clients, our people and society. Significant impacts are topics where our impact is significant and/or that have a (potential) significant impact on our firm and the way we do business. All material topics are disclosed in accordance with the European Sustainability Reporting Standards. Emerging impacts are topics that as such do not yet meet the thresholds we have defined for materiality, but we believe will gain traction over the mid to longer term. These topics are disclosed in a qualitative way in our reporting.

We intend to update our Double Materiality Assessment for our 2024/2025 reporting, to include the conclusions of the Double Materiality Assessment that is currently performed by NSE.

Material topics

Following our assessment, we have identified the following material topics for our 2023/2024 reporting:

Table 02: Material topics

Area | Topics 2022/2023 | Topics 2023/2024 | Pages |

1. Quality | - Quality of services | - Quality of services | 178-181 |

- Data security | - Data security | 184-186 | |

2. Ethics | - Ethics & integrity | - Ethics & integrity | 181-184 |

3. Talent | - Employee value proposition | - Employee value proposition | 157-161 |

- Inclusion and diversity | - Diversity, equity and inclusion | 162-165 | |

- Learning and development | - Learning and development | 165-169 | |

- Wellbeing | - Wellbeing | 169-171 | |

4. Innovation | - Innovation | ||

5. Impact on society | - Climate & CO2 emissions | - Climate & CO2 emissions | 135-155 |

- Social impact (a.o. DIF) | - Social impact / social return | 171-177 |

Compared to the previous year, we have removed ‘Innovation' as a material topic as innovation is outside of the domain of sustainability as defined by the ESRS and is not part of the ESG landscape. Innovation, however, remains one of the cornerstones of our strategy. We have relabelled ‘Inclusion & diversity’ to ‘Diversity, equity and inclusion’ to do justice to the objectives and scope of our activities.

Many of our material topics relate to one or more sustainability matters as identified by the European Sustainability Reporting Standards (ESRS). Please see the table below for an overview.

Table 03: Connection between ESRS and Deloitte material topics

Deloitte material impact | Includes ESRS sustainability matter(s) |

Climate & CO2 emissions | Climate change adaptation (ESRS-E1) |

Climate change mitigation (ESRS-E1) | |

Energy (ESRS-E1) | |

Employee Value Proposition | Training and skills development (ESRS-S1) |

Diversity, equity and inclusion | Gender equality and equal pay for work of equal value (ESRS-S1) |

Training and skills development (ESRS-S1) | |

Employment and inclusion of persons with disabilities (ESRS-S1) | |

Measures against violence and harassment in the workplace (ESRS-S1) | |

Diversity (ESRS-S1) | |

Learning & development | Training and skills development (ESRS-S1) |

Wellbeing | Work-life balance (ESRS-S1) |

Health (and safety) (ESRS-S1) | |

Social impact / social return | - |

Quality of services | - |

Ethics and integrity | Corporate culture (ESRS-G1) |

Protection of whistle-blowers (ESRS-G1) | |

Corruption and bribery (ESRS-G1) | |

Data security | - |

Affected stakeholder groups

For our material impacts, the following stakeholder groups are considered to be affected and/or users of our sustainability statements:

Table 04: Affected stakeholders

Material impact | Affected stakeholders | Users of information |

Quality | Our people, clients, regulators | Clients, regulators, public opinion, peers, financial institutions |

Data security | Clients, regulators | Clients, regulators, public opinion |

Ethics & integrity | Our people, clients, regulators, suppliers | Our people, clients, regulators, public opinion, peers, financial institutions, suppliers |

Climate and CO2 | Our people, clients | Our people, clients, public opinion, peers, financial institutions |

Diversity, equity and inclusion | Our people | Our people, clients, public opinion |

Employees value proposition | Our people | Our people, graduates and experienced talent, peers |

Training & education | Our people, clients, regulators, peers | Public opinion |

Wellbeing | Our people | Our people, peers, regulators |

Social impact / social return | Our people, clients, society | Our people, clients, public opinion, peers, financial institutions |

Please see Table 01 above for a description on how we engage with our stakeholders.

1.3 Reporting boundaries

There is an overlap of topics and related opportunities noted by our internal and external stakeholders. Most of these topics relate to our internal organisation. For this reason, our reporting on these topics is limited to our performance within our direct sphere of influence, unless indicated otherwise. This is the case for our Scope 3 emissions upstream and where we discuss our due dilligence processes upstream and downstream.

1.4 Reliability and completeness

We have collected the relevant performance data from our business information systems as supported by our internal control and monitoring systems, and from suppliers and other sources. This is centrally recorded and thereafter reviewed by our Finance & Control department and the KPI owners.

1.5 Reporting process

Central to our approach to reporting is the IAR Project team. This team is headed by our Chief Financial Officer and consists of representatives from Finance & Control and Finance & Accounting, combined with specialists from our Risk Advisory business’s Sustainability Group and supported by Brand and Communication. Content planning and development takes place under the supervision of the Executive Board, with internal oversight by the Audit & Finance Committee and the Supervisory Board. We have engaged our independent external auditor, BDO Audit & Assurance B.V., to provide reasonable assurance on our financial data (Annex 1) and limited assurance on our sustainability statement (Annex 2) in the PDF version of this report. The assurance report of BDO Audit & Assurance B.V. can be found in Annex 4 of the PDF. The Report is published after approval by the General Meeting.