About Deloitte

Deloitte Netherlands is the Dutch firm of Deloitte North and South Europe (NSE) and as such is a separate and independent legal entity. Deloitte Netherlands operates in the Netherlands and in the Dutch Caribbean. For a full list of subsidiaries, please see our financial statements.

In the Netherlands, we employ over 8,000 people (excluding contractors) in 16 different offices around the country. This makes us one of the leading Dutch professional services providers in the areas of audit, tax and legal advisory, consultancy, risk advisory and financial advisory. Our practitioners work in multidisciplinary teams applying a broad vision and in-depth approach to help resolve our clients challenges and realise opportunities.

In December 2022, Deloitte acquired PACER, a leading engineering and consulting firm that operates both nationally and internationally in the fields of infrastructure and investment projects. PACER provides services in all disciplines within a project: project management, project management, contract management, technical management (systems engineering) and environmental management. PACER was founded in 2007 and is now part of Deloitte's Responsible Infrastructure & Capital Projects team within Risk Advisory.

Deloitte NSE

Deloitte NSE brings together around 50,000 professionals. Together, we make an even greater impact in each of our markets. By working as a unified firm and leveraging our network, we can achieve more – for our clients, our people and the communities we work in.

Deloitte NSE comprises the following countries: the Netherlands (incl. Deloitte Dutch Caribbean), the UK & Switzerland, Ireland, Belgium, Finland, Denmark, Sweden, Norway, Iceland, Italy, Greece, Malta, Libya, Palestinian ruled territories, Cyprus, Lebanon, Jordan, Iraq, Egypt, Saudi Arabia, Kuwait, Bahrain, Qatar, the Republic of the Sudan, the United Arab Emirates, Oman and Yemen.

Deloitte Global

Building on over 175 years of experience, our global organisation has grown in scale and diversity and now comprises approximately 415,000 people in more than 150 countries and territories, serving 90% of Fortune Global 500® companies and almost all the Amsterdam Exchange Index companies, providing assurance services or, to non-audit clients, advisory services. Our professionals deliver measurable and lasting results that help reinforce public trust in capital markets, enable clients to transform and thrive, and lead the way towards a stronger economy, a more equitable society and a more sustainable world.

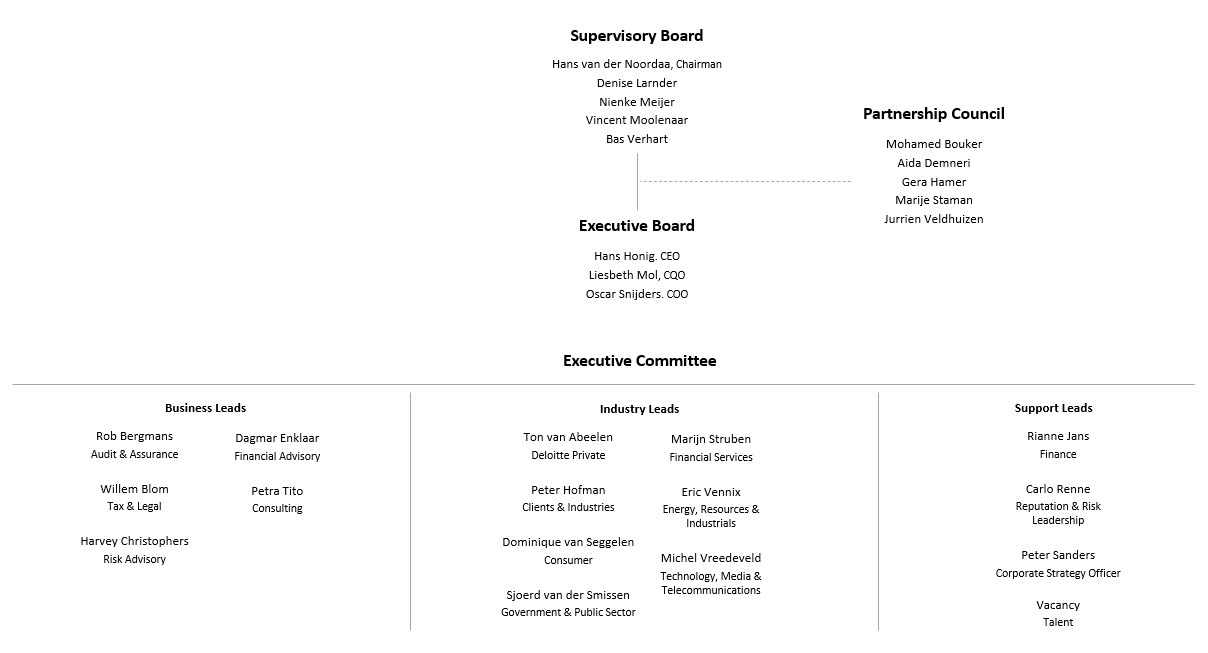

Our leadership in 2022/2023 (per May 31, 2023)

Per June 1, 2023, the following changes have taken place:

-

Rob Bergmans has been appointed Chief People & Quality Officer succeeding Liesbeth Mol. Rob will also lead Group Support Center;

-

Dagmar Enklaar has been appointed Chief Operations Officer succeeding Oscar Snijders;

-

Gera Hamer has been appointed Business Lead Audit & Assurance succeeding Rob Bergmans;

-

Petra Tito has been appointed Business Lead Consulting succeeding Erik Nanninga;

-

Baldwin Kramer has been appointed Business Lead Financial Advisory succeeding Dagmar Enklaar;

-

Willem Gooskens has been appointed Business Lead Tax & Legal succeeding Willem Blom;

-

Marije Staman has been appointed Industry Lead Deloitte Private succeeding Ton van Abeelen;

-

Roën Blom has been appointed Industry Lead Technology, Media & Telecommunications succeeding Michel Vreedeveld;

-

Marike Maas and Bas Savert have been appointed as members of the Partnership Council to replace Gera Hamer and Marije Staman;

-

Mariëtte Los has been appointed as Talent Lead (CHRO) per August 1, 2023.

Our engagement approach

To consistently deliver high-quality services to our clients, we maintain a common engagement approach.

Financial performance

Business results

Our revenues 2022/2023 have grown moderately compared to last year and reached €1,359 million. The growth rate was 7.1% (2021/2022: €1,270 million). Growth is primarily impacted by a slow-down in demand following clients postponing decisions, while overall demand is still high. The slow-down is driven by increased uncertainty caused by the conflict between Russia and Ukraine, which fueled inflation and specifically energy prices despite increasing interest rates.

While the availability of resources was still an issue in 2021/2022, this was not a major challenge in 2022/2023. We were able to attract many new colleagues in The Netherlands and our vision remains to make more intensive use of our Global Delivery Network (GDN), which consists of selected strategic delivery centres.

Solid growth has been realised in most Businesses given the economic environment. Tax & Legal and Risk Advisory showed performance with double digit revenue growth. Given the increase in client serving staff and the removal of COVID restrictions, the demand from our businesses increased. As a consequence training costs increased, which has the support of management, while other costs required proper management attention to contain overhead costs. Our result before tax and management fees amounted to €164.8 million (2021/2022: €201.6 million).

As a percentage of revenues, our result before tax and management fees decreased to 12.1% from 15.9% in 2021/2022. This result is amongst others a consequence of a strong increase in local resources and related salary costs. In addition, we continued to invest in our employees, and the terms of employment benefitted from changes as a result of our Employee Value Proposition, also affecting salary costs. The result is also impacted by lower productivity levels following a slow-down in demand combined with increasing costs, which amongst others relates to training and travelling to our clients and offices as well as continued investments in technology at both global, NSE and local level. Whereas last year, variable compensation benefitted from our performance, this year the variable pay is adversely impacted by the lower margins realised and consequently impacting our employees. The variable compensation decreases from €79.2 million in 2021/2022 to €31.6 million in 2022/2023.

Solvency and liquidity

Solvency based on equity, membership capital and subordinated loans (group’s capital base) is 20.6% (19.0%). Our year-end cash balance decreased to €7.6 million following an adverse net cash flow. Our working capital, defined as the sum of unbilled services, advanced billings and accounts receivable, remained stable at €341.7 million, which is €0.4 million lower than last year. With management’s focus on improving working capital despite the increasing complexity following large international projects and growing revenues, keeping our working capital stable is a positive development which we aim to maintain.

For a full overview of and detailed notes to our financial performance, please see the Financial Statements, which are annexed to this report.

Taxation

As a responsible business, our policy is to comply fully with the spirit and the letter of Dutch tax legislation. To enhance our transparency on this topic, we have adopted a Tax policy, that can be found in the Annexes of this report.

Our Tax policy addresses the three main types of national taxation that are applicable to us: corporate tax, tax on wages and value added tax.

Corporate tax

Deloitte’s partners/owners charge Deloitte a management fee through a personal management company These management fees are fully taxable at the level of the individual management company, in accordance with the regular Dutch corporate income tax rates. Deloitte’s remaining profit is taxable at Deloitte level, subject to the regular Dutch corporate income tax rates.

All filings for corporate income tax returns from Deloitte and the individual management companies of the partners/owners are prepared centrally by Deloitte in line with the guidelines agreed with the Dutch Tax Authority (DTA). Cross-border projects or other international services are agreed with Chief Tax Officers in other countries to ensure Deloitte meets local rules and regulations.

Wage tax

All relevant filings are carried out in a timely manner and in accordance with local rules and regulations. Meetings are held regularly with specialists from the DTA to discuss pending and new tax issues, such as charging travel expenses, cost reimbursements and the so-called free space in the wage tax declaration.

All cross-border work situations (including secondments, projects and expatriates) are handled by a dedicated group of specialists to ensure that Deloitte and its employees meet all Dutch and local requirements.

Value added tax

On all incoming and outgoing transactions, we follow the rules and guidelines for value added tax (VAT). Specific transactions are subject to strict protocols to ascertain that VAT is reported correctly. VAT is also subject to the self-initiated sample as described above, and findings are reported to the DTA in full transparency.

Material impacts

Each year, we evaluate the topics that we believe are material to Deloitte. This year, we have changed the approach to our evaluation to align it with both the principle of impact materiality (GRI) and 'double materiality' (impact and financial materiality) as defined by the (draft) European Sustainability Reporting Standards. An explanation of our approach can be found on pages 124-130 of this report. Following our materiality assessment, we have identified the following material topics for our 2022/2023 reporting:

Area | Topic | Links to strategic imperitive | Pages | |

1. | Quality | - Quality of services | Embrace quality and responsible business | 155-156 |

- Data security | Embrace quality and responsible business | 159-160 | ||

2. | Ethics & integrity | - Ethics & integrity | Embrace quality and responsible business | 156-159 |

3. | Talent | - Employee value proposition | Strengthen engagement and inclusiveness | 138-144 |

- Inclusion and diversity | Strengthen engagement and inclusiveness | 144-147 | ||

- Learning and development | Strengthen engagement and inclusiveness | 147-149 | ||

- Wellbeing | Strengthen engagement and inclusiveness | 149-150 | ||

4. | Innovation | - Innovation | Accelerate innovation | 160-161 |

5. | Impact on society | - Climate & CO2 emissions | Embrace quality and responsible business | 132-137 |

- Social impact (a.o. DIF) | Embrace quality and responsible business | 151-154 |

For a comparison of the material impacts included in this report compared to those in our previous one, please see page 130.