Combined independent auditor’s and assurance report

To: the general meeting and Supervisory Board of Coöperatief Deloitte U.A.

Summary

The full text of the independent auditor’s report, which includes the audit opinion on the financial statements and the reasonable assurance report on the other (integrated) information included in the Integrated Annual Report has been included in the following pages.

The other (integrated) information in scope of our audit is included in the sections Key numbers of value creation, About this Report, Executive Board highlights, lessons learned and outlook (excluding outlook), Our Purpose and Strategy, About Deloitte, Roles and Responsibilities, Risk management, Annex 2: Non-financial statements, Basis of reporting and GRI content index (hereafter: the other (integrated) information in the Integrated Annual Report).

Financial statements | Other (integrated) information in the Integrated Annual Report | |

Opinion | Unqualified opinion on financial statements. | Unqualified reasonable assurance opinion on the other (integrated) information in the Integrated Annual Report. |

Materiality |

| Based on our professional judgement we determined materiality levels for each relevant part of the other (integrated) information and for the other (integrated) information as a whole. |

Key audit matters |

| Reliable and adequate view on material theme Quality of services. |

A. Report on the audit of the financial statements and other (integrated) information 2022/2023 included in the Integrated Annual Report

Our opinion

We have audited the financial statements 2022/2023 of Coöperatief Deloitte U.A. based in Rotterdam, the Netherlands. The financial statements comprise the consolidated financial statements and the company financial statements.

WE HAVE AUDITED | OUR OPINION |

The financial statements comprise:

| In our opinion, the accompanying financial statements give a true and fair view of the financial position of Coöperatief Deloitte U.A. as at May 31, 2023 and of its result and its cash flows for 2022/2023 in accordance with International Financial Reporting Standards as adopted by the European Union (EU-IFRS) and with Part 9 of Book 2 of the Dutch Civil Code. |

Basis for our opinion

We conducted our audit in accordance with Dutch law, including the Dutch Standards on Auditing and Dutch Standard 3810N ‘Assurance-opdrachten inzake maatschappelijke verslagen’ (Assurance engagements relating to sustainability reports). Our responsibilities under those standards are further described in the ‘Our responsibilities for the audit of the financial statements and the other (integrated) information in the Annual Report’ section of our report.

We are independent of Coöperatief Deloitte U.A. in accordance with the EU Regulation on specific requirements regarding statutory audit of public-interest entities, the Wet toezicht accountantsorganisaties (Wta, Audit firms supervision act), the Verordening inzake de onafhankelijkheid van accountants bij assurance-opdrachten (ViO, Code of Ethics for Professional Accountants, a regulation with respect to independence). Furthermore, we have complied with the Verordening gedrags- en beroepsregels accountants (VGBA, Dutch Code of Ethics).

We believe the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

B. Information in support of our opinion

We designed our audit procedures in the context of our audit of the financial statements and the (other) integrated information as a whole and in forming our opinion thereon. The following information in support of our opinion was addressed in this context, and we do not provide a separate opinion or conclusion on these matters.

Reporting criteria financial statements

The information outlined in the scope of our engagements needs to be read and understood together with the reporting criteria, for which Coöperatief Deloitte U.A. is solely responsible for selecting and applying, taking into account applicable laws and regulations related to reporting. The criteria used for the preparation of the consolidated and company financial statements are EU-IFRS and Part 9 of Book 2 of the Dutch Civil Code, respectively.

Reporting criteria other (integrated) information in the Integrated Annual Report

The reporting criteria used for the preparation of the other (integrated) information are the Sustainability Reporting Standards of the Global Reporting Initiative (GRI) and the applied supplemental reporting criteria as disclosed on page 123-124 of the annual report.

The sustainability information is prepared in accordance with the GRI Standards. The GRI Standards used are listed in the GRI content index as disclosed on page 173-175 of the annual report.

The absence of an established practice on which to draw, to evaluate and measure non-financial information allows for different, but acceptable, measurement techniques and can affect comparability between entities and over time. Consequently, the other (integrated) information needs to be read and understood together with the reporting criteria used.

Materiality

Based on our professional judgement we determined the materiality for the financial statements as a whole at € 11,400,000. The materiality is based on a benchmark of income before tax and management fee (representing approximately 7% of reported income before tax and management fee). We applied this benchmark based on our analysis of the common information needs of users of the financial statements. On this basis, we believe that the income before tax and management fee is an important metric for the financial performance of the group. We have also taken into account misstatements and/or possible misstatements that in our opinion are material for the users of the financial statements for qualitative reasons.

We agreed with the Supervisory Board that misstatements in excess of € 550,000, which are identified during the audit, would be reported to them, as well as smaller misstatements that in our view must be reported on qualitative grounds.

Materiality other (integrated) information in the Integrated Annual Report

Based on our professional judgement we determined materiality levels for each relevant part of the other (integrated) information and for the other (integrated) information as a whole. When evaluating our materiality levels, we have taken into account quantitative and qualitative considerations as well as the relevance of information for both stakeholders and the company.

We agreed with the Supervisory Board that misstatements which are identified during the audit and which in our view must be reported on quantitative or qualitative grounds, would be reported to them.

Scope of the group audit

Coöperatief Deloitte U.A. is at the head of a group of entities. The financial information of this group is included in the consolidated financial statements of Coöperatief Deloitte U.A.

Our group audit mainly focused on significant group entities. We consider an entity significant when:

-

it is of individual financial significance to the group;

-

the component, due to its specific nature or circumstances, is likely to include significant risks of material misstatement, whether due to fraud or error of the group financial statements.

To this extent, for the purpose of the audit of the consolidated financial statements, we performed audit procedures for all of the following significant group entities:

-

Deloitte Risk Advisory B.V.

-

Deloitte Accountants B.V.

-

Deloitte Belastingadviseurs B.V.

-

Deloitte Consulting B.V.

-

Deloitte Financial Advisory B.V.

-

Deloitte Holding B.V.

In addition, we performed specific audit procedures for other group entities.

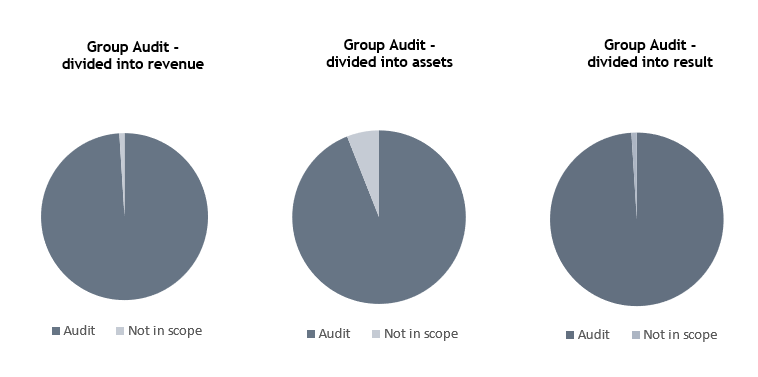

For clarification purposes we hereby show our scope divided into revenue, assets and result:

By performing the procedures mentioned above at group entities, together with additional procedures at group level, we have been able to obtain sufficient and appropriate audit evidence about the group’s financial information to provide an opinion on the consolidated financial statements.

Audit approach going concern

As explained in the section 'Going concern' in note 1 of the financial statements, management has carried out a going concern assessment and identified no going concern risks. Our procedures to evaluate the going concern assessment of management includes:

-

We agreed the opening cash position used in the cash flow forecast to the audited position at 31 May 2023;

-

We performed an accuracy check on the mechanics of the cash flow forecast model prepared by management;

-

We assessed managements’ financial forecasts prepared for a period of at least 12 months from the date of these financial statements. This included consideration of the reasonableness of key underlying assumptions by reference to current and future expected operating and capital expenditure; and

-

We evaluated the adequacy of disclosures made in the financial statements in respect of going concern.

These audit procedures did not lead to any material findings regarding the going concern assumption of the Company.

Audit approach fraud risks and non-compliance with laws and regulations

We identified and assessed the risks of material misstatements of the financial statements due to fraud and non-compliance with laws and regulations.

During our audit we obtained an understanding of the entity and its environment and the components of the system of internal control, including the risk assessment process and management’s process for responding to the risks of fraud and monitoring the system of internal control and how the supervisory board exercises oversight, as well as the outcomes.

We refer to section ‘Risk management’ of the management report for the fraud risk assessment and section ‘Report from the Supervisory Board’, in which the supervisory board reflects on management’s fraud risk assessment.

We evaluated the design and relevant aspects of the system of internal control and in particular the fraud risk assessment, as well as among others the code of conduct, whistle blower procedures and incident registration. We evaluated the design and the implementation and, where considered appropriate, tested the operating effectiveness, of internal controls designed to mitigate fraud risks.

As part of our process of identifying fraud risks, we evaluated fraud risk factors with respect to financial reporting fraud, misappropriation of assets and bribery and corruption. We evaluated whether these factors indicate that a risk of material misstatement due to fraud is present.

We identified the following fraud risks and performed the following specific procedures:

We performed risk assessment procedures to identify potential risks of material misstatements due to fraud and non-compliances with laws and regulations. As part of this work we evaluated the group’s risk assessment and performed inquiries with management and those charged with governance. We also specifically evaluated whether fraud risk factors are present based on the framework of the fraud triangle during several team discussions and considered any unusual or unexpected relationships based on analytical procedures. As part of this assessment, we specifically assessed how fraud risks can arise in the revenue recognition as part of the unbilled revenue process and reflected this in our risk assessment and audit approach.

Following these procedures, and the presumed risks under the prevailing audit standards, we considered (presumed) fraud risks related to management override of controls and related to the overstatement of (unbilled) revenues. We consider these fraud risks to also be prevalent as a result of the nature of the group, where the compensation of partners and senior management personnel are driven and based on the annual profits achieved. The partners/senior management therefore might have pressure or incentives to unjustly modify certain aspects of the financial statements in order to increase the profits achieved with the aim to increase their respective compensation. This would especially be relevant for financial statement areas such as unbilled revenue and provisions, such as the professional liability provision or other areas involving significant estimates.

In relation to our risk assessment on non-compliance with laws and regulation, we performed procedures to obtain an understanding of the legal and regulatory frameworks that are applicable for Coöperatief Deloitte U.A.. The potential effect of laws and regulations on the financial statements varies considerably. Resulting from our risk assessment procedures, we considered adherence to (corporate) tax law and financial reporting with a direct effect on the financial statements as an integrated part of our audit procedures to the extent these are material for the financial statements.

In addition to the aforementioned laws and regulation, Coöperatief Deloitte U.A.is subject to other laws and regulations where the consequences of non-compliance could have a material effect on amounts and/or disclosures in the financial statements, for instance through imposing fines or litigation. Examples of such other laws and regulations are those relating to the supervision of the Financial Market Authority (AFM) based on the Wta and data privacy laws. Auditing standards limit the required audit procedures to identify non-compliance with these laws and regulations to enquiry of the directors and other management and inspection of regulatory and legal correspondence, if any. Therefore, if a breach of operational regulations is not disclosed to us or evident from relevant correspondence, an audit will not detect such breaches.

Our audit procedures to respond to the risk of management override and identify potential other fraud elements include, amongst others:

-

We inquired the procedures for compliance with laws and regulations with relevant personnel, including Board of Directors, Reputation & Risk Leader and the Ethics Officer.

-

We inspected minutes of meetings of the Supervisory Board, Executive Board and Quality Integrity & Risk Committee.

-

We inspected correspondence with regulators.

-

We evaluated the design and the implementation and, where considered appropriate, tested the operating effectiveness of internal controls that mitigate fraud risks.

-

Supplementary to reliance on the internal controls, we performed substantive audit procedures, including detailed testing of journal entries with a risk-based approach.

-

We reviewed significant accounting estimates for biases and evaluated whether the circumstances producing the bias, if any, represent a risk of material misstatement due to fraud. As part of this we performed a retrospective review and evaluated the judgements and decisions made by management in making the estimates in the current year.

-

We remained alert for indications of fraud throughout our other audit procedures and evaluated whether identified findings or misstatements were indicative of fraud.

-

We assessed matters reported on the group’s whistleblowing and complaints procedures and assessed, where deemed necessary, the results of management’s follow-up of such matters.

-

We performed an assessment of any significant extraordinary events outside of the normal course of business

-

We obtained written representations that all known instances of (suspected) fraud or non-compliance with laws and regulations have been disclosed to us.

-

We evaluated whether final analytical procedures performed near the end of the audit, when forming an overall conclusion as to whether the financial statements are consistent with our understanding of the group, indicate a previously unrecognized risk of material misstatement due to fraud.

Our response in addressing fraud risks related to the valuation of unbilled services and advance billings to customers is detailed in our key audit matters.

Our audit procedures in relation to non-compliance with laws and regulations notably consists of:

-

We inquired the procedures for compliance with laws and regulations with relevant personnel, including Board of Directors, Reputation & Risk Leader and the Ethics Officer.

-

We inspected minutes of meetings of the Supervisory Board, Executive Board and Quality Integrity & Risk Committee.

-

We inspected correspondence with regulators.

-

We obtained sufficient appropriate audit evidence regarding compliance with the provisions of those laws and regulations generally recognized to have a direct effect on the determination of material amounts and disclosures in the financial statements, where we also included a specialist in the area of corporate tax law.

-

We performed limited procedures in relation to other laws and regulations, i.e. we performed inquiries with management and those charged with governance as to whether the group is in compliance with such laws and regulations and we inspected correspondence, if any, with the relevant authorities.

-

During the audit, we remained alert to the possibility that other audit procedures applied may bring instances of non-compliance or suspected non-compliance with laws and regulations to our attention.

-

We obtained management representation that all known instances of non-compliance or suspected non-compliance with laws and regulations whose effects should be considered when preparing integrated annual report are adequately disclosed in the financial statements.

We incorporated elements of unpredictability in our audit. We also considered the outcome of our other audit procedures and evaluated whether any findings were indicative of fraud or non-compliance.

We considered available information and made enquiries of relevant executives, directors (including internal audit, legal, risk) and the supervisory board.

The audit procedures described above have resulted in sufficient and appropriate audit evidence to mitigate the potential fraud risks and non-compliance risks. Our audit procedures did not lead to indications or suspicions for fraud potentially resulting in material misstatements.

For an overview of our responsibilities and those of the management regarding the financial statements and the risks of fraud and non-compliance, we refer to section D. of this report.

Our key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial statements and the other (integrated) information. We have communicated the key audit matters to the Supervisory Board. The key audit matters are not a comprehensive reflection of all matters discussed.

These matters were addressed in the context of our audit of the financial statements and the other (integrated) information as a whole and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

VALUATION OF UNBILLED SERVICES AND ADVANCE BILLINGS TO CUSTOMERS | OUR AUDIT APPROACH |

As at May 31, 2023 the recognised unbilled services (contract assets) amounts to € 139 million. Refer to note 3.2 - Unbilled services and advance billings to customers. The valuation of unbilled revenues and advanced billings to customers as at the financial year-end requires a significant degree of management estimate that may be complex and inherently subjective in nature. This requires the group to estimate the expected results of current engagements based on an estimate of time and costs to be incurred, the estimate of expected additional billing on fixed fee projects and the assessment of the collectability of unbilled amounts. We considered the valuation of unbilled services to be a key audit matter due to its significance, subjectivity in the estimates of the valuation of the unbilled revenues and the fraud risk in revenue recognition. | We evaluated the design and tested implementation of both automated and manual internal controls within the organisation relating to the valuation of the unbilled revenues and advance billings to customers. We tested the operational effectiveness of the internal controls that were considered relevant for our audit, to validate the appropriate recognition of revenues and the existence and accuracy of gross unbilled revenue prior to the application of provisions. In addition to the reliance taken on effective internal control measures in place, we applied tailored data analytical procedures focusing on partner portfolio profitability and partner portfolio profitability trends -including major contrary effects within portfolios- to identify any tendencies through management bias. Furthermore, we performed substantive audit procedures on specific elements not yet fully addressed by aforementioned procedures, i.e. cut-off testing including realisation of success fees, onerous contracts and (non) chargeable hours. In addition, we performed substantive audit procedures regarding the valuation of unbilled services and advance billings by testing the estimate of expected results and recorded fees, including any overruns and scope changes to supporting documentation (e.g. contracts) for a sample of projects. We also tested journal entries related to unbilled services and advance billings to customers. Finally, we assessed the adequacy of the related disclosures in the financial statements. |

VALUATION OF PROFESSIONAL LIABILITY PROVISION | OUR AUDIT APPROACH |

The group is involved in a number of disputes in the ordinary course of business which may give rise to claims. Refer to note 8.2 – Provisions and note 8.3 Commitments and guarantees for the disclosures with respect to such claims and legal proceedings. The professional liability provision is based on assumptions of, amongst others the existence of a present obligation and measurement of the expected amount to settle the claim. Furthermore an assessment is made if the estimated provision falls inside the scope of insurance policies or if the amount exceeds the maximum coverage of the insurance policies. We considered the valuation of the provision for professional liability provision a key audit matter due to the high degree of subjectivity and complexity in the assumptions. | In addition to testing the design and operating effectiveness of the provisional indemnity claims process and related control procedures, the audit procedures mainly comprised of substantive audit procedures. These procedures notably consisted of:

Furthermore, we assessed the adequacy of the related disclosures relating to professional liability in the financial statements. |

FAIR VIEW ON MATERIAL THEME QUALITY OF SERVICES | OUR AUDIT APPROACH |

With regard to the other (integrated) information, one of the most material topics is Quality of services. As a result, this topic is the most important part of our audit of the other (integrated) information in the Integrated Annual Report. | We determined which information in the other (integrated) information refers to the material topic Quality of services. We made a distinction between numerical information and text claims. With respect to this information we determined the design of the internal control framework regarding this theme. Regarding the numerical information, we reconciled the numerical information to underlying databases. We determined the reliability of the information in these databases by reconciling the information to supporting external and internal information. For the text claims, we examined a selection of the texts based on professional judgement, and made a reconciliation with supporting external and internal information. |

Limitations to the scope of our audit

The other (integrated) information includes prospective information such as ambitions, strategy, plans, expectations, estimates and risk assessments. Inherent to this prospective information, the actual future results are uncertain. We do not provide any assurance on the assumptions and achievability of prospective information in the other (integrated) information in the Integrated Annual Report.

The references to external sources or websites in the other (integrated) information are not part of the other (integrated) information in the Integrated Annual Report as audited by us. We therefore do not provide assurance on this information. Our opinion is not modified in respect to these matters.

C. Report on other information included in the Integrated Annual Report

In addition to the financial statements and our auditor’s report thereon, the Integrated Annual Report contains other information that consists of:

-

Key numbers of value creation;

-

About this Report;

-

Executive Board highlights, lessons learned and outlook;

-

Our Purpose and strategy;

-

About Deloitte;

-

Report of the Supervisory Board;

-

Risk management;

-

Annex 2: Non-financial statements;

-

Annex 3: Supporting documentation;

-

Annex 4: Other information.

Based on the following procedures performed, we conclude that the other information (excluding outlook information):

-

is consistent with the financial statements and does not contain material misstatements;

-

contains the information as required by Part 9 of Book 2 of the Dutch Civil Code.

We have read the other information. Based on our knowledge and understanding obtained through our audit of the financial statements or otherwise, we have considered whether the other information contains material misstatements.

By performing these procedures, we comply with the requirements of Part 9 of Book 2 of the Dutch Civil Code and the Dutch Standard 720. The scope of the procedures performed is substantially less than the scope of those performed in our audit of the financial statements. Refer to paragraph A for elaboration of the elements of other information for which we obtained reasonable assurance.

Management is responsible for the preparation of the other information, including the management report in accordance with Part 9 of Book 2 of the Dutch Civil Code and other information as required by Part 9 of Book 2 of the Dutch Civil Code.

D. Report on other legal and regulatory requirements

Engagement

We were engaged by the Supervisory Board as auditor of Coöperatief Deloitte U.A. for the audit of the financial year ended May 31, 2023 on January 16, 2023.

No prohibited non-audit services

We have not provided prohibited non-audit services as referred to in Article 5(1) of the EU Regulation on specific requirements regarding statutory audit of public-interest entities.

E. Description of responsibilities regarding the financial statements

Responsibilities of management and the Supervisory Board for the financial statements and other (integrated) information in the Integrated Annual Report

Management Board is responsible for the preparation and fair presentation of the financial statements in accordance with EU-IFRS and Part 9 of Book 2 of the Dutch Civil Code. The Management Board is also responsible for the preparation of reliable and adequate other (integrated) information in accordance with the reporting criteria in the ‘Reporting criteria other (integrated) information in the Integrated Annual Report’ section, including the identification of stakeholders and the definition of material matters. The management board is also responsible for selecting and applying the reporting criteria and for determining that these reporting criteria are suitable for the legitimate information needs of stakeholders, taking into account applicable law and regulations related to reporting. The choices made by the management board regarding the scope of the other (integrated) information and the reporting policy are summarised in chapter ‘Basis of preparation’ of the Integrated Annual Report.

Furthermore, management is responsible for such internal control as it determines necessary to enable the preparation of the financial statements and the other (integrated) information that are free from material misstatement, whether due to fraud or error.

As part of the preparation of the financial statements, management is responsible for assessing the company’s ability to continue as a going concern. Based on the financial reporting frameworks mentioned, management should prepare the financial statements using the going concern basis of accounting, unless management either intends to liquidate the company or to cease operations, or has no realistic alternative but to do so.

Management should disclose events and circumstances that may cast significant doubt on the company’s ability to continue as a going concern in the financial statements.

The Supervisory Board is responsible for overseeing Coöperatief Deloitte U.A.’s reporting process.

Our responsibilities for the audit of the financial statements and the other (integrated) information in the Integrated Annual Report

Our responsibility is to plan and perform the audit engagement in a manner that allows us to obtain sufficient and appropriate audit evidence for our opinion.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. The materiality affects the nature, timing and extent of our audit procedures and the evaluation of the effect of identified misstatements on our opinion.

We have exercised professional judgement and have maintained professional skepticism throughout the audit, in accordance with Dutch Standards on Auditing, ethical requirements and independence requirements. Our audit on the financial statements included among others:

-

identifying and assessing the risks of material misstatement of the financial statements, whether due to fraud or error, designing and performing audit procedures responsive to those risks, and obtaining audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control;

-

obtaining an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control;

-

evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management;

-

concluding on the appropriateness of management’s use of the going concern basis of accounting, and based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause a company to cease to continue as a going concern;

-

evaluating the overall presentation, structure and content of the financial statements, including the disclosures; and

-

evaluating whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

Our audit of the other (integrated) information in the Integrated Annual Report included among others:

-

Performing an analysis of the external environment and obtaining an understanding of relevant sustainability themes and issues, and the characteristics of the company;

-

Evaluating the appropriateness of the reporting criteria used, their consistent application and related disclosures in the other (integrated) information. This includes the evaluation of the results of the stakeholders’ dialogue and the reasonableness of estimates made by the management board;

-

Obtaining an understanding of the systems and processes for collecting, reporting and consolidating the other (integrated) information, including obtaining an understanding of internal control relevant to our audit, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control;

-

Identifying and assessing the risks if the other (integrated) information is misleading or unbalanced, or contains material misstatements, whether due to fraud or error. Designing and performing further audit procedures responsive to those risks, and obtaining audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk that the other (integrated) information is misleading or unbalanced, or the risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from errors. Fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. These procedures consisted amongst others of:

-

-

Interviewing management (and/or relevant staff) at corporate (and business/division/cluster/local) level responsible for the sustainability strategy, policy and results;

-

Interviewing relevant staff responsible for providing the information for, carrying out internal control procedures on, and consolidating the data in the sustainability information;

-

Determining the nature and extent of the audit procedures for the group components and locations. For this, the nature, extent and/or risk profile of these components are decisive.

-

Obtaining assurance evidence that the sustainability information reconciles with underlying records of the company;

-

Evaluating relevant internal and external documentation, on a test basis, to determine the reliability of the information in the sustainability information;

-

Performing an analytical review of the data and trends.

-

-

Reconciling the relevant financial information with the financial statements;

-

Evaluating the consistency of the other (integrated) information with the information in the annual report which is not included in the scope of our audit

-

Evaluating the overall presentation and content of the other (integrated) information;

-

Considering whether the other (integrated) information as a whole, including the disclosures, reflects the purpose of the reporting criteria used.

Because we are ultimately responsible for the opinion, we are also responsible for directing, supervising and performing the group audit. In this respect we have determine the nature and extent of the audit procedures to be carried out for group entities. Decisive were the size and/or the risk profile of the group entities or operations. On this basis, we selected group entities for which an audit or review had to be carried out on the complete set of financial information or specific items.

We communicate with the Supervisory Board regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant findings in internal control that we identified during our audit.

We provide the Supervisory Board with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with the Supervisory Board, we determine the key audit matters: those matters that were of most significance in the audit of the financial statements. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, not communicating the matter is in the public interest.

For and on behalf of BDO Audit & Assurance B.V.,

Rotterdam, July 18, 2023

Drs. A. Thomson RA