1. Basis of preparation

This Report has been prepared in accordance with the GRI Standards, and the International <IR> Framework of the International Integrated Reporting Council (IIRC). The GRI Content Index is included in this report (see pages 173-176). We have also included a CSRD Reference Table to make visible what we have disclosed in anticipation of the transposition of this directive. As Deloitte is a member of UN Global Compact the Netherlands, we report our impact with a focus on the UN Sustainable Development Goals that we deem most relevant to Deloitte.

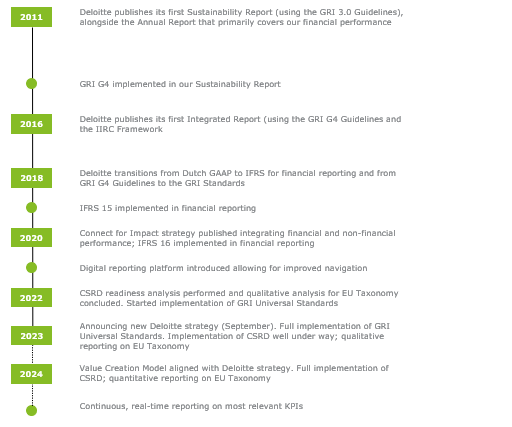

Deloitte aims to be at the forefront of public reporting and has a long-standing practice of voluntarily disclosing audited, financial and non-financial information. Reporting to us is an evolutionary process where every year, we aim to improve on what we have done before and implement the latest reporting insights and requirements.

The evolution of our reporting

Following the EU Taxonomy, Deloitte will be required to report the percentage of eligible and aligned turnover, CAPEX, and OPEX (contributing to the six environmental objectives from the EU Green Deal) for our financial year 2024/2025. We have, therefore, identified the eligible and possibly aligned activities contributing to the first two environmental objectives of as part of our CSRD preparations.

The most notable eligible capital expenditure (CAPEX) refers to the lease of our buildings, classified under the activity 7.7 “Buying real estate and exercising ownership of that real estate”, as four of our buildings in the Netherlands have at least an Energy Performance Certificate (EPC) class A.

The most notable eligible turnover refers to activity 9.3 ‘Professional services related to energy performance of buildings’ as Deloitte is an accredited auditor for the energy performance of buildings, and provides performance assessments for real estate clients.

The most notable eligible operating expenditure (OPEX) refers to Activity 6.5 ‘Transport by motor bikes, passenger cars, and light commercial vehicles’, as a substantial amount of the passenger cars leased by Deloitte have tailpipe CO2 emissions equal to 0g CO2 e/km.

We present an overview of eligible activities that we have identified below:

OPEX and CAPEX

-

6.5. Transport by motorbikes, passenger cars and light commercial vehicles (OPEX)

-

7.7. Acquisition and ownership of buildings (CAPEX/ OPEX)

-

1.1 Afforestation (OPEX)

-

1.3 Forest management (OPEX)

-

6.4. Operation of personal mobility devices, cycle logistics (OPEX)

-

5.5. Collection and transport of non hazardous waste (OPEX)

-

7.2, 7.3, 7.5, 7.6. Renovation of buildings, maintenance of energy efficiency equipment, energy performance devices, renewable energy technologies (CAPEX/ OPEX)

-

7.4. EV charging stations in buildings and parking spaces (CAPEX/ OPEX)

-

8.1. Data processing, hosting and related activities (OPEX)

-

11.1. Education (OPEX)

Revenues

-

8.2. Computer programming, consultancy and related activities

-

9.1. Engineering activities and related technical consultancy dedicated to adaptation to climate change

-

9.1. Close to market research, development and innovation

-

8.2. Data driven solutions for GHG emissions reductions

-

9.2. Research, development and innovation for direct air capture of CO2

-

9.3. Professional services related to energy performance of buildings

-

11.1. Education

In 2023/2024, we will assess whether these activities can be aligned. To this end, we will also align with other Deloitte firms within the European Union. One of the elements we need to investigate further is the ability for our systems to generate sufficient and reliable data on the activities now identified.

1.1 Scope

In this Report, ‘Deloitte’ refers to Coöperatief Deloitte U.A. and its subsidiaries as listed in the ‘Notes to the specific items on the financial statements’ in Annex 1. The performance of Deloitte Dutch Caribbean (DDC) is integrated in our non-financial data, unless otherwise indicated. Coöperatief Deloitte U.A. is the firm for the Dutch geography within Deloitte North and South Europe (NSE), the second-largest member firm of Deloitte Touche Tohmatsu Limited.

For the purpose of this report, we apply the following definitions regarding the scoping of time:

-

Short-term: one year;

-

Middle-term: one to four years (in line with our strategic cycle);

-

Long-term: over four years.

1.2 Materiality

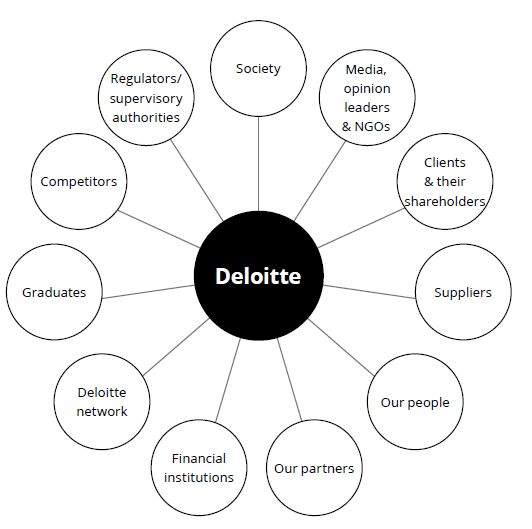

We interact with our stakeholders to seek their opinions and their expectations. This process allows us to define a timely and adequate response to the issues they deem important for our business and for our ability to make an impact that matters.

We actively seek our stakeholders’ views

We aim to take our stakeholders seriously. To this end, throughout the year, we actively engage in dialogue or seek their opinions in other manners such as through (social) media scanning.

Table 01: Means of stakeholder engagement

Stakeholder groups | How we seek their views |

Clients & their shareholders | Client Service Assessments |

Engagement quality assessments | |

Client meetings and (digital) events | |

Requests for proposals | |

Clients & Industries research | |

External research and ratings | |

Media scanning | |

Our people | Talent survey |

Sustainability survey and focus groups | |

Discussions with Works Council | |

Formal and informal meetings, including virtual townhalls | |

Feedback / comments from individuals | |

Our partners | Formal and informal partner meetings |

Receiving feedback | |

Graduates | Surveys and research |

Participation in campus events | |

Recruitment sessions | |

Deloitte network | Active participation in key DTTL and NSE governance bodies |

International cooperation around issues or assignments | |

Regulators | Formal and informal meetings |

Media scanning | |

Media, Opinion leaders & NGOs | One-on-one engagements |

Cooperation with knowledge institutes such as universities | |

Media scanning | |

Society | Active participation of Deloitters in society |

Media scanning | |

Competitors | Active participation in trade and industry platforms |

One-on-one sessions around themes or issues | |

Media scanning | |

Suppliers | Contract management |

Media scanning | |

Financial institutions | One-on-one engagements |

Media scanning |

Our engagement in 2022/2023

In 2022/2023, we focused on the following stakeholder groups, as we deem these groups to have the greatest impact on our business:

-

Employees

-

Clients

-

Deloitte network

-

Regulators

-

Competitors

-

Financial institutions

-

Public opinion

-

New hires

For stakeholder groups that we did not explicitly engage with, we built on the stakeholder insights we obtained over the past reporting years. For the stakeholders listed above, we provide an overview of the insights that we gained for updating our materiality matrix.

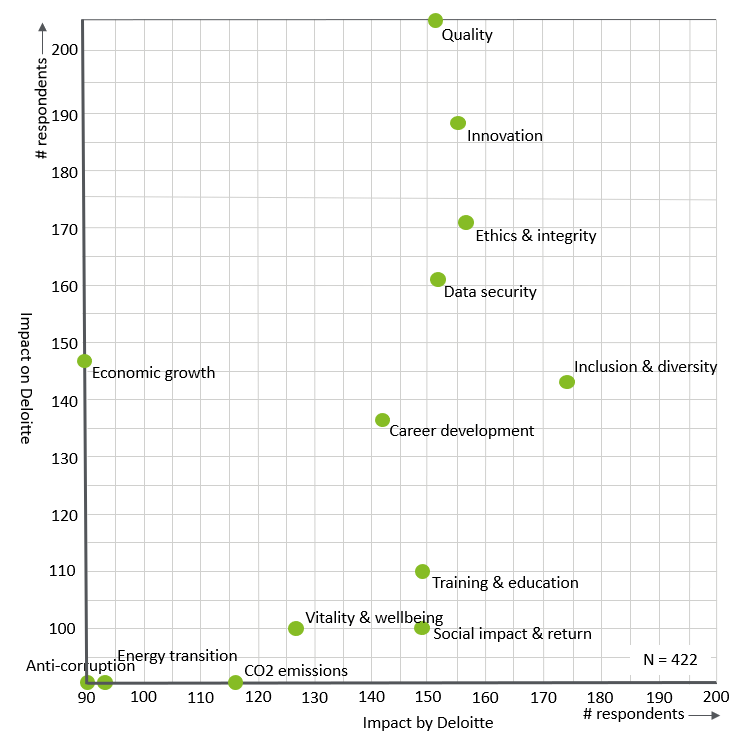

Employees

In Q3, we conducted an internal sustainability survey in which 422 of our partners and employees participated. One of the aims of this survey was to obtain better insights into the sustainability topics that our employees deem relevant to Deloitte. To assess their views as input for our (double) materiality analysis, we asked them to select the five topics where they believed Deloitte has the biggest impact in the short and medium term (0-3 years). We also asked our people to select five topics they believed that have the greatest impact on Deloitte's operations, reputation and financial success in the short and medium term. We have selected all topics that were chosen more than 90 times (therefore by more than 20% of all respondents) and plotted these in a diagram with the impact by Deloitte on the horizontal axes and the impact on Deloitte on the vertical axis.

In addition, we asked our partners and people which topics (maximum of five per respondent) they believe will be important in the long term (>7 years) both from the perspective of the impact by Deloitte and the impact on Deloitte. The results of this question can be summarised as follows:

-

CO2 emissions (mentioned by 163 respondents)

-

Energy (158)

-

Innovation (152)

-

Data security (140)

-

Ethics & Integrity (136)

-

Vitality & wellbeing (114)

-

Biodiversity (114)

-

Quality (113)

-

Social impact & social return (108)

-

Economic growth (106)

-

Inclusion & diversity (106)

-

Sustainable procurement (90)

Clients

Our clients turn to Deloitte for relevant insights and high quality professional services that help their businesses become more responsible and sustainable, and thus progress and thrive. Quality, in all its aspects, is the key driver for our success, as is our ability to quickly adapt to the changing needs of our clients regarding the expertise they seek from us. To ensure both quality and adaptability, continuous learning, development of our people, and the ability to innovate are key requirements, as is international cooperation to deliver high quality engagements across borders.

To perform our services, in many cases our clients entrust us with sensitive data. The integrity of our IT systems and the prevention of data leaks is of vital importance to the trust that our clients have in Deloitte. Privacy and data security are therefore highly important topics to us.

Larger corporate clients and public sector clients are especially aware that their responsibility reaches beyond their direct operations and also involves parts of their value chain. Typical topics that these clients are interested in are: climate impact and GHG emissions, environmental management and certification, human rights, labour rights, public commitments in the area of sustainability, and human trafficking and slavery.

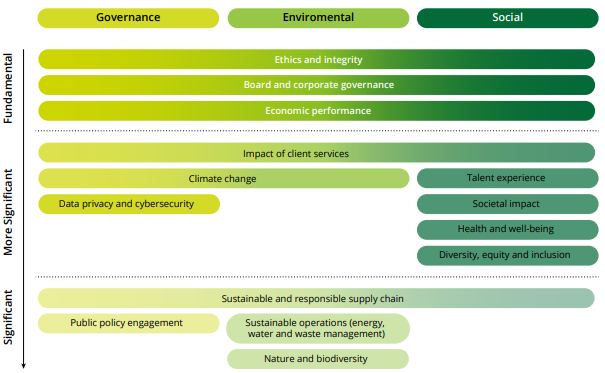

Deloitte network

DTTL has its own process for determining materiality, the outcome of which provides input for our materiality assessment. The material topics from DTTL are depicted in the graph below:

Through the Deloitte network (DTTL), we submit our CO2 emissions to the Carbon Disclosure Project (CDP). In addition, DTTL has policies and programmes in place in the area of corporate citizenship (WorldClass). Next to these sustainability related practices, DTTL maintains strict guidance in the areas of quality, ethics & integrity, privacy, data security, and anti-corruption.

Regulators / public policy

We have formal and informal engagements with our regulators and public policy makers. During the reporting year, the focus of our regulators/public policy continued on the following themes:

Regulators

During our engagements with regulators, their focus was on the following themes: quality (fraud, continuity), Implementation of ISQM1, independence, learning, attractiveness of profession, IKO (the results of internal engagement quality reviews and results of system of quality review), use of data analytics and data-driven supervision.

Public policy

We have comprehensive relationship management plans in place for key stakeholders such as Members of Parliament and Cabinet. In 2022/2023, the Public Policy team focused on engaging with policy makers on key themes such as work, financial health, digital and sustainability. In addition, policy makers expect Deloitte to contribute to the solution of complex social challenges and we experience a great interest in our 'Future of' agenda.

The outcome of our dialogue with regulators/public policy relates to the following topics: quality of services, credibility/trust/integrity, learning and development, and social impact.

Competitors

We have benchmarked our material topics and related performance against those of the other Big4 firms for 2021/2022. This benchmark shows that all three other Big4 deem the following topics material to their business: Mental and physical wellbeing of employees, Quality of audit and advisory services, and Technological innovation / Growing use of digital technologies throughout the economy. Topics that are deemed material by two of the other Big 4 are: Retaining, recruiting and developing employees, Diversity and inclusiveness, Integrity and independence, Emissions of own operations, and Community investment / impact on society.

Public opinion

We constantly monitor public opinion and actively scan media for emerging topics. Our efforts in 2022/2023 show that the following topics have the most hits on Google in relation to Deloitte: Inclusiveness and diversity, Wellbeing, Customer satisfaction, Ethics, Career development, Environmental care, and Climate.

Financial institutions

We have discussed sustainability in relation to our credit facilities with the banks that we use for financial transactions. Of course, all topics that relate to Deloitte’s ability to do business (quality, talent attraction and retention, innovation, etc.) are of interest to our banks as they ultimately determine our financial viability. In the context of a sustainable financing credit facility that we agreed in May 2022, a discount on interest due has been formulated when we fulfil pre-defined targets on CO2 reduction. Deloitte and the banks have indicated that upon completion of the new strategy, we will consider the inclusion of additional targets around social impacts such as inclusion & diversity and talent (engagement).

New hires

By nature, our business is characterised by a high employee turnover and changing skill sets. Combined with the growth of our business, this means that we are constantly recruiting new talent. Deloitte's Global 2022 GenZ & Millennial Survey provides a wealth of insights into the desires and expectations from our (future) colleagues. Analysis of the Survey shows that the following topics are of specific interest to new hires:

-

Visible climate action

-

Mental health

-

Work-life balance

-

Employment / income / cost of living

-

Inclusiveness, diversity and equality

-

Social impact / purpose

-

Learning / development opportunity

-

Sexual harassment

-

Hybrid working

-

Personal safety

-

Healthcare / disease prevention

-

Salary & other financial benefits

Assessing impacts

After identifying relevant topics, we have assessed the actual and potential impacts of the topics both from an inside-out and an outside-in perspective. In this process we have made use of the insights we have gained from the (preliminary) outcomes of our Strategic Impact Assessment (SIA) project. This project aims to monetise social impacts allowing for comparison and strategic steering. Once we have validated the results of SIA with a broader stakeholder audience, we intend to disclose the outcomes. Consequently, we have discussed our selection with internal experts in the area of sustainability and impact. In March 2023, we have presented our findings to the Executive Board, which has ultimately determined the material topics for our financial year 2022/2023.

Fundamental material impacts are those that are overarching requirements that we must meet in order to strengthen market leadership and make an impact on clients, our people and society. Significant impacts are topics where our impact is significant and/or that have a significant impact on our firm and the way we do business. All material topics are disclosed in accordance with GRI Standards and as much as currently possible with the (future) CSRD requirements. Emerging impacts are topics we believe will gain traction over the mid to longer term and that we disclose in a qualitative way in our reporting.

Material topics

Following our assessment, we have identified the following material topics for our 2022/2023 reporting:

Table 2: Material topics

Area | Topics 2021/2022 | Topics 2022/2023 |

1. Quality | - Quality of services | - Quality of services |

- Privacy | - Data security | |

- Data security | ||

2. Ethics | - Ethics & integrity | - Ethics & integrity |

- Anti-corruption | ||

3. Talent | - Employee value proposition | - Employee value proposition |

- Inclusion and diversity | - Inclusion and diversity | |

- Learning and development | - Learning and development | |

- Wellbeing | - Wellbeing | |

4. Innovation | - Innovation | - Innovation |

5. Impact on society | - Climate & CO2 emissions | - Climate & CO2 emissions |

- Social impact (a.o. DIF) | - Social impact (a.o. DIF) | |

- Sustainable procurement |

Compared to the previous year, we have removed 'Privacy', 'Anti-Corruption' and 'Sustainable procurement' as material topics. We address 'Privacy' in the context of 'Data security' and discuss 'Anti-corruption' in the context of 'Ethics & integrity'. 'Sustainable procurement' remains in focus as an emerging topic, as our analysis shows that it is likely to become more important in the future.

1.3 Reporting boundaries

There is an overlap of topics and related opportunities noted by our internal and external stakeholders. Most of these topics relate to our internal organisation. For this reason, our reporting on these topics is limited to our performance within our direct sphere of influence, unless indicated otherwise (for example, where we discuss our value creation in a broader context).

1.4 Reliability and completeness

We have collected the relevant performance data from our business information systems as supported by our internal control and monitoring systems, and from suppliers and other sources. This is centrally recorded and thereafter reviewed by our Finance & Control department. We have engaged our independent external auditor, BDO Audit & Assurance B.V., to provide reasonable assurance on both the financial and the non-financial information in the PDF version of this report. The combined independent auditor’s and assurance report of BDO Audit & Assurance B.V. can be found in Annex 4 of the PDF.

1.5 Reporting process

Central to our approach to reporting is the IAR Project team. This team is headed by our Chief Financial Officer and consists of representatives from Finance & Control and Finance & Accounting, combined with specialists from our Risk Advisory business’s Sustainability Group and supported by Brand and Communication. Content planning and development takes place under the supervision of the Executive Board, with internal oversight by the Audit & Finance Committee and the Supervisory Board. The Report is published after approval by the General Meeting.